Title: US Banks Stock Index: A Comprehensive Overview

Banks(10)Index(49)Stock(3211)Title(842)Compre(62)

Introduction: The US banks stock index has long been a key indicator of the financial health and stability of the American banking sector. As investors and financial analysts closely monitor this index, understanding its composition, performance, and factors influencing it becomes crucial. In this article, we will delve into the intricacies of the US banks stock index, exploring its significance, composition, and the key factors that drive its movement.

Understanding the US Banks Stock Index:

Composition of the US Banks Stock Index: The composition of the US banks stock index can vary slightly depending on the specific index being referenced. However, it generally includes well-known and influential banks such as JPMorgan Chase, Bank of America, Wells Fargo, Citigroup, and Goldman Sachs. These banks contribute significantly to the index's performance and are often seen as representative of the broader banking sector.

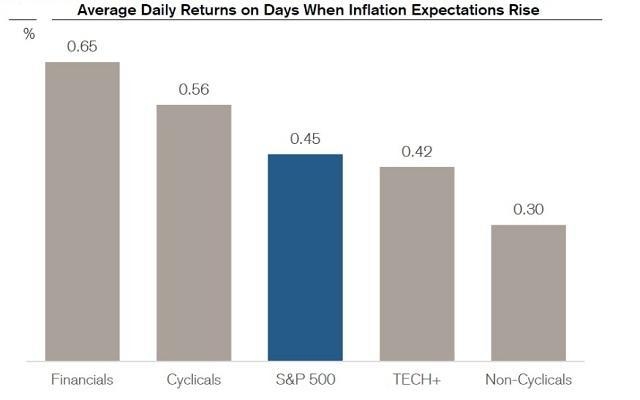

Performance of the US Banks Stock Index: The performance of the US banks stock index can be influenced by various factors, including economic conditions, interest rates, regulatory changes, and corporate earnings. Over the years, the index has demonstrated a strong correlation with the broader stock market, often moving in tandem with market trends.

Key Factors Influencing the US Banks Stock Index:

Economic Conditions: The health of the economy plays a crucial role in the performance of the US banks stock index. Strong economic growth typically leads to higher loan demand, increased profitability, and a positive impact on the index.

Interest Rates: The Federal Reserve's monetary policy decisions regarding interest rates have a significant impact on the banking sector. Higher interest rates can boost net interest margins, while lower rates may put downward pressure on profitability.

Regulatory Changes: Changes in banking regulations can have a profound effect on the US banks stock index. Stricter regulations may increase compliance costs and reduce profitability, while looser regulations may have the opposite effect.

Corporate Earnings: The financial performance of individual banks within the index directly influences its overall performance. Strong earnings reports can drive the index higher, while disappointing results can lead to a decline.

Case Study: The Impact of the Financial Crisis on the US Banks Stock Index: The financial crisis of 2008 had a profound impact on the US banks stock index. Many banks faced significant challenges, leading to a sharp decline in the index. However, over time, as the economy recovered and banks stabilized their operations, the index began to rebound. This case study highlights the importance of economic conditions and corporate performance in driving the index's movement.

Conclusion: The US banks stock index serves as a vital indicator of the financial health and stability of the American banking sector. By understanding its composition, performance, and the key factors influencing it, investors and financial analysts can make informed decisions. As the banking industry continues to evolve, keeping a close eye on the US banks stock index will remain crucial for those seeking to navigate the complexities of the financial markets.

can foreigners buy us stocks

like

- 2026-01-20US Senator Sold Stock: The Controversy and Implications

- 2026-01-18Title: List of US Stock Symbols: A Comprehensive Guide for Investors

- 2026-01-20Live Us Stock Market Charts: Real-Time Insights for Investors

- 2026-01-16Invest in Us Stocks from Australia on Pinterest: A Guide for Australian Investors

- 2026-01-20Best Long-Term US Stocks to Watch in 2023

- 2026-01-20Fusion Energy Stocks: Top US Companies to Watch

- 2026-01-16Tencent Holdings US Stock Symbol: A Comprehensive Guide

- 2026-01-15China vs. US Stocks: A Comprehensive Analysis

- 2026-01-20Best Energy Stocks in the US: Top Picks for 2023"

- 2026-01-18US Hotel Stocks: A Comprehensive Guide to Investing in the Hospitality Industry