Is the US Stock Market Saturated?

Saturated(1)The(1536)Market(888)Stock(3211)

In the world of finance, the term "saturated" often refers to a market that has reached its full potential for growth. When it comes to the US stock market, investors are often left pondering whether it has reached its saturation point. This article delves into this question, exploring the factors that contribute to market saturation and examining whether the US stock market has truly reached its peak.

Understanding Market Saturation

What Does it Mean for the US Stock Market to Be Saturated?

Market saturation is typically characterized by a high number of participants, intense competition, and a limited number of opportunities for growth. In the context of the US stock market, saturation would imply that there are so many companies listed that it has become difficult for new entrants to gain traction. This could be due to a variety of factors, including regulatory hurdles, market demand, and investor sentiment.

Historical Context

The US stock market has seen significant growth over the past century. However, it is important to consider the historical context when assessing whether the market is saturated. For instance, the dot-com bubble of the late 1990s saw a surge in the number of tech companies going public. While many of these companies did not survive, the market as a whole continued to grow.

Current Market Trends

Today, the US stock market is home to a diverse range of companies across various industries. This includes technology, healthcare, finance, and consumer goods, among others. Despite this diversity, some experts argue that the market is becoming more saturated due to several factors:

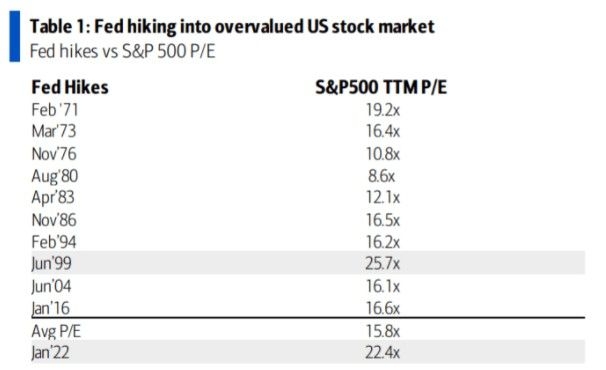

High Valuations: Many companies are currently trading at high valuations, which can be a sign of market saturation. This is particularly true for tech stocks, which have seen significant growth in recent years.

Limited Growth Opportunities: With many companies already listed, new entrants may find it difficult to gain market share. This can lead to increased competition and a flattening of growth rates.

Regulatory Challenges: The process of going public can be costly and time-consuming, which may deter new companies from entering the market.

Case Studies

To better understand the current state of the US stock market, let's look at a few case studies:

Facebook (now Meta Platforms): Facebook's initial public offering (IPO) in 2012 was one of the largest in history. Since then, the company has faced significant challenges, including regulatory scrutiny and a loss of user trust. This highlights the challenges that even established companies can face in a saturated market.

Tesla: Tesla's rapid growth has been a significant driver of the electric vehicle (EV) market. However, the company has faced intense competition from new entrants, such as Rivian and Lucid. This competition may indicate that the EV market is becoming more saturated.

Conclusion

Whether the US stock market is truly saturated is a matter of debate. While some argue that the market is becoming more saturated, others believe that there are still opportunities for growth. It is important for investors to remain vigilant and conduct thorough research before making investment decisions. As the market continues to evolve, it will be interesting to see how it adapts to the challenges of saturation.

us stock market live

like

- 2026-01-15Should I Hold U.S. Stocks in My TFSA?

- 2026-01-17Title: Top US Solar Power Stocks to Watch in 2023

- 2026-01-15Air France US Stock: A Comprehensive Guide

- 2026-01-17Title: US Small Cap Tech Stocks: A Lucrative Investment Opportunity

- 2026-01-172025 Triple Witching Dates: A Key Event for the US Stock Market

- 2026-01-18Most Active US Stocks in May 2025: A Comprehensive Analysis

- 2026-01-17US Alloy Stock: The Ultimate Guide to High-Quality Metal Solutions

- 2026-01-18US Stock Indices Today: A Comprehensive Overview

- 2026-01-15Upcoming Stock Splits: US Companies to Watch in 2025

- 2026-01-20US Large Cap Stocks: Momentum Top Performers Over 5 Days"