The Great Boomer Selloff May Overwhelm Us Stocks

Great(4)Boomer(1)Selloff(1)May(17)The(1536)O(18)

The stock market has been on a rollercoaster ride lately, and experts are warning that the Great Boomer Selloff could overwhelm the market. As baby boomers approach retirement age, they are expected to start liquidating their portfolios to fund their retirement years, which could lead to a significant sell-off that could overwhelm the stock market. In this article, we will explore the potential impact of the Great Boomer Selloff on the stock market and what investors can do to prepare.

Understanding the Great Boomer Selloff

The Great Boomer Selloff refers to the mass liquidation of stock portfolios by baby boomers, who are currently between the ages of 55 and 73. This demographic group represents a significant portion of the stock market, and their retirement plans are heavily dependent on their investment portfolios.

As baby boomers approach retirement age, they are looking to generate income from their investments to fund their retirement years. This could lead to a significant sell-off of stocks, as they look to cash out their investments and move to safer, more stable assets.

The Potential Impact on the Stock Market

The Great Boomer Selloff has the potential to overwhelm the stock market for several reasons:

Massive Amount of Wealth: Baby boomers represent a significant portion of the wealth in the stock market. The liquidation of their portfolios could lead to a substantial amount of selling pressure on the market.

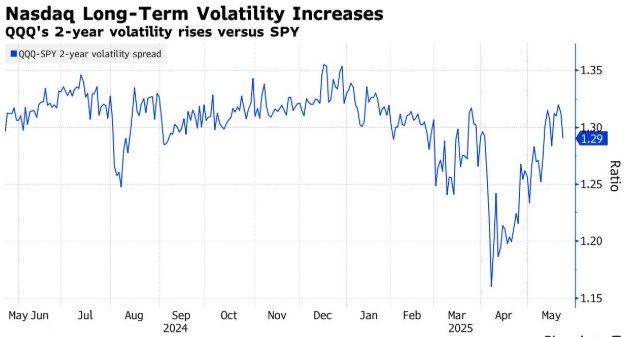

Market Volatility: The selloff could lead to increased market volatility, as investors react to the sell-off and the uncertainty it brings.

Long-term Impacts: The Great Boomer Selloff could have long-term impacts on the stock market, as the shift in investment focus from stocks to other assets could alter the market dynamics.

What Investors Can Do to Prepare

To prepare for the potential impact of the Great Boomer Selloff, investors should consider the following steps:

Diversify Your Portfolio: Diversification can help reduce the impact of market volatility and protect your investments during times of uncertainty.

Review Your Retirement Plan: Assess your retirement plan and ensure that it aligns with your investment goals and risk tolerance.

Consider Alternative Investments: Explore alternative investments such as bonds, real estate, or annuities, which can provide stability and income during retirement.

Stay Informed: Keep up with market trends and expert opinions to stay informed about the potential impact of the Great Boomer Selloff on the stock market.

Case Study: The Dot-com Bubble

A notable historical example of a demographic-driven market selloff is the Dot-com Bubble of the late 1990s. As technology stocks surged in value, many investors, including baby boomers, piled into the market, looking for high returns. When the bubble burst in 2000, many investors, particularly those close to retirement, suffered significant losses. This serves as a cautionary tale for the potential impact of the Great Boomer Selloff on the stock market.

The Great Boomer Selloff has the potential to overwhelm the stock market, and investors need to prepare for the potential impacts. By diversifying their portfolios, reviewing their retirement plans, and considering alternative investments, investors can help protect their investments during this period of uncertainty. As always, staying informed and consulting with a financial advisor can provide valuable insights to navigate the challenges ahead.

us stock market live

like

- 2026-01-172025 Triple Witching Dates: A Key Event for the US Stock Market

- 2026-01-17US Alloy Stock: The Ultimate Guide to High-Quality Metal Solutions

- 2026-01-17Title: US Small Cap Tech Stocks: A Lucrative Investment Opportunity

- 2026-01-20US Large Cap Stocks: Momentum Top Performers Over 5 Days"

- 2026-01-15Air France US Stock: A Comprehensive Guide

- 2026-01-18US Stock Indices Today: A Comprehensive Overview

- 2026-01-15Upcoming Stock Splits: US Companies to Watch in 2025

- 2026-01-17Title: Top US Solar Power Stocks to Watch in 2023

- 2026-01-18Most Active US Stocks in May 2025: A Comprehensive Analysis

- 2026-01-15Should I Hold U.S. Stocks in My TFSA?