Can Australians Invest in the US Stock Market?

Australians(2)Can(134)The(1536)Invest(158)Sto(144)

Are you an Australian investor looking to expand your portfolio internationally? The US stock market is one of the most robust and diversified markets in the world, offering numerous opportunities for growth and investment. In this article, we will explore whether Australians can invest in the US stock market and provide a comprehensive guide on how to do so effectively.

Understanding the Basics

First and foremost, it is essential to understand that investing in the US stock market as an Australian citizen involves navigating different regulatory frameworks and currency conversions. However, it is entirely feasible to invest in US stocks, provided you have the right information and guidance.

Regulatory Framework

As an Australian investor, you need to be aware of the Australian Securities and Investments Commission (ASIC) regulations. According to ASIC, Australians are allowed to invest in foreign securities, including US stocks, provided they comply with certain requirements.

How to Invest in the US Stock Market

1. Open a Brokerage Account

The first step in investing in the US stock market is to open a brokerage account. There are numerous brokerage firms that offer services to international investors, including Fidelity, TD Ameritrade, and E*TRADE.

2. Convert Currency

As an Australian investor, you will need to convert your Australian dollars to US dollars. Most brokerage firms offer currency conversion services, or you can use online platforms like TransferWise or CurrencyFair.

3. Research and Analyze

Before investing in any stock, it is crucial to conduct thorough research and analysis. Look for companies with strong fundamentals, such as a solid financial track record, a strong management team, and a competitive edge in their industry.

4. Place Your Order

Once you have identified a stock you wish to invest in, you can place your order through your brokerage account. You can choose from various order types, such as market orders, limit orders, and stop orders.

5. Monitor Your Investment

After placing your order, it is essential to monitor your investment regularly. Keep an eye on the company's financial performance, market trends, and any news that may impact the stock's price.

Case Study: investing in Apple (AAPL)

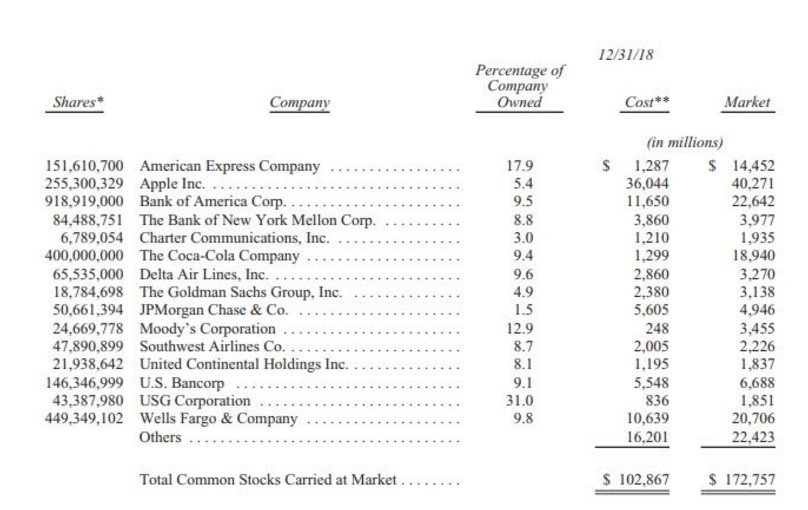

As an example, consider the case of investing in Apple Inc. (AAPL). Apple is a well-established technology company with a strong track record of innovation and growth. As of the time of writing, AAPL is one of the most valuable companies in the world, with a market capitalization of over $2 trillion.

An Australian investor might consider investing in AAPL due to its stable dividend yield and growth potential. However, it is essential to conduct thorough research on the company's financial health, competitive position, and market trends before making any investment decisions.

Conclusion

In conclusion, Australians can invest in the US stock market, provided they follow the necessary steps and regulations. By opening a brokerage account, converting currency, conducting thorough research, and monitoring your investments, you can successfully invest in the US stock market and potentially grow your wealth.

Remember to seek professional advice before making any investment decisions, as the stock market carries inherent risks. With the right approach and guidance, investing in the US stock market can be a rewarding experience for Australian investors.

us stock market today live cha

like

- 2026-01-15Understanding the US Dollar Stock Symbol: A Comprehensive Guide

- 2026-01-20JPMorgan's Dimon Warns of Inflated US Stock Market

- 2026-01-17Hot US Stocks to Watch in July 2025

- 2026-01-18US Momentum Stocks: Top Performers Over the Past 5 Days in August 2025

- 2026-01-16Title: US Blue Chip Stocks 2016: A Comprehensive Overview

- 2026-01-18QCOM US Stock Price: What You Need to Know

- 2026-01-15How to Buy US OTC Stocks in the UK

- 2026-01-18Top Momentum US Stocks Today: A Deep Dive into the Market's Hot Picks

- 2026-01-20How Major US Stock Indexes Fared on April 8, 2025"

- 2026-01-15Title: US Election Results and Their Impact on the Stock Market