Gold ETF US Stock: A Lucrative Investment Avenue

Gold(15)Inves(24)ETF(58)Lucrative(45)Stock(3211)

Investing in the stock market can be an intimidating endeavor, especially for beginners. However, with the right investment tools and strategies, anyone can navigate this complex world with confidence. One such tool that has gained immense popularity among investors is the Gold ETF US Stock. This article delves into what Gold ETF US Stock is, its benefits, and how you can leverage it for your investment portfolio.

Understanding Gold ETF US Stock

A Gold ETF (Exchange Traded Fund) is a type of investment fund that tracks the price of gold. When you invest in a Gold ETF US Stock, you are essentially buying shares of a fund that holds physical gold or gold-related assets. The value of these shares is directly tied to the price of gold, making it an excellent hedge against inflation and market volatility.

Why Invest in Gold ETF US Stock?

1. Inflation-Proof Investment: Gold has historically been a reliable hedge against inflation. As the value of the dollar declines, the price of gold tends to rise, protecting your investment from the eroding effects of inflation.

2. Diversification: Including gold in your investment portfolio can provide diversification, which can help reduce your overall risk. Gold often performs differently from other asset classes, such as stocks and bonds, making it an excellent addition to a well-rounded portfolio.

3. Safe Haven: During times of economic uncertainty and market volatility, gold tends to be a safe haven for investors. This is because gold is often seen as a store of value and a way to preserve capital.

4. Accessibility: Investing in a Gold ETF US Stock is a straightforward process. You can purchase shares of the ETF through a brokerage account, making it easily accessible to investors of all levels.

How to Invest in Gold ETF US Stock

To invest in a Gold ETF US Stock, you need to follow these simple steps:

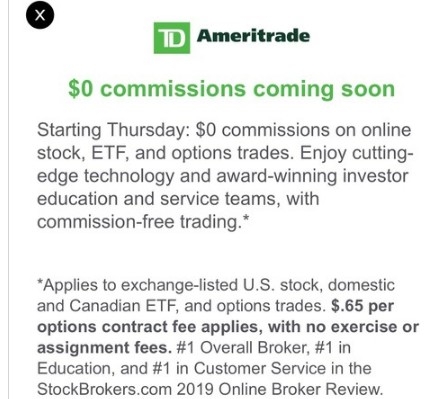

Open a Brokerage Account: The first step is to open a brokerage account if you don't already have one. Many online brokers offer low-cost or free trading services.

Research Gold ETFs: There are several Gold ETFs available, each with its own unique features. Some popular Gold ETFs include the SPDR Gold Trust (GLD), the iShares Gold Trust (IAU), and the Invesco DB Gold Fund (DGL).

Fund Your Account: Once you have chosen a Gold ETF, fund your brokerage account with the required amount of money.

Place Your Order: Finally, place an order to buy shares of the Gold ETF through your brokerage account.

Case Study: Gold ETF US Stock During the 2008 Financial Crisis

One of the most notable examples of the benefits of investing in a Gold ETF US Stock is during the 2008 financial crisis. As the stock market plummeted, the price of gold surged. Investors who held Gold ETFs saw their investments increase significantly, providing a much-needed buffer against the market's volatility.

Conclusion

Investing in a Gold ETF US Stock can be a smart and strategic move for your investment portfolio. With its ability to provide diversification, protect against inflation, and act as a safe haven during economic uncertainty, it's no wonder that many investors are turning to Gold ETFs as a way to secure their financial future.

us stock market today live cha

like

- 2026-01-18QCOM US Stock Price: What You Need to Know

- 2026-01-18Top Momentum US Stocks Today: A Deep Dive into the Market's Hot Picks

- 2026-01-15Understanding the US Dollar Stock Symbol: A Comprehensive Guide

- 2026-01-16Title: US Blue Chip Stocks 2016: A Comprehensive Overview

- 2026-01-15How to Buy US OTC Stocks in the UK

- 2026-01-18US Momentum Stocks: Top Performers Over the Past 5 Days in August 2025

- 2026-01-15Title: US Election Results and Their Impact on the Stock Market

- 2026-01-17Hot US Stocks to Watch in July 2025

- 2026-01-20JPMorgan's Dimon Warns of Inflated US Stock Market

- 2026-01-20How Major US Stock Indexes Fared on April 8, 2025"