Unlocking the Potential of US Stocks: A Comprehensive Guide

Stocks(1955)Unlocking(110)The(1536)Potential(93)

Are you looking to diversify your investment portfolio and explore the vast opportunities that the United States stock market has to offer? "US O Stock" refers to the stock market of the United States, and it's a financial powerhouse that has been a cornerstone for investors worldwide. In this article, we'll delve into the basics of investing in US stocks, the benefits of doing so, and how to get started.

Understanding the US Stock Market

The US stock market is one of the largest and most influential in the world. It's home to numerous publicly-traded companies across various industries, from technology giants like Apple and Microsoft to energy behemoths like ExxonMobil. The two primary exchanges where US stocks are traded are the New York Stock Exchange (NYSE) and the NASDAQ.

Benefits of Investing in US Stocks

- Potential for High Returns: Historically, investing in US stocks has provided investors with substantial returns. While there are risks involved, the potential for long-term growth is significant.

- Diversification: Investing in US stocks allows you to diversify your portfolio, reducing your exposure to the risks associated with any single stock or sector.

- Access to Global Leaders: The US stock market is home to many of the world's most successful companies. By investing in these companies, you gain exposure to their global operations and potential growth.

- Market Liquidity: The US stock market is known for its high liquidity, which means you can buy and sell stocks quickly and easily.

How to Get Started

- Choose a Brokerage Account: The first step in investing in US stocks is to open a brokerage account. There are numerous brokerage firms to choose from, each offering different features and fees. Some popular options include TD Ameritrade, E*TRADE, and Charles Schwab.

- Research and Select Stocks: Once you have your brokerage account, you'll need to research and select stocks to invest in. This can be done through fundamental analysis, which involves analyzing a company's financial statements and industry position, or technical analysis, which involves studying price and volume patterns.

- Understand Risks: It's crucial to understand the risks associated with investing in stocks. These include market risk, which is the risk of a general decline in the stock market, and company-specific risk, which is the risk associated with a particular company's performance.

- Start Small: If you're new to investing, it's a good idea to start small. This will allow you to gain experience and learn from any mistakes without risking a significant amount of money.

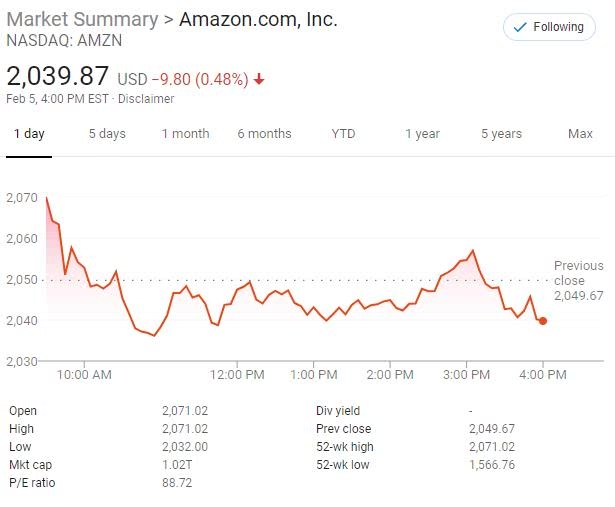

Case Study: Amazon

One of the most successful companies in the US stock market is Amazon. Founded in 1994, Amazon started as an online bookstore and has since grown into a global retail and technology giant. By investing in Amazon's stock, investors have seen significant returns over the years. This case study highlights the potential of investing in US stocks.

Conclusion

Investing in US stocks can be a lucrative venture for those who do their homework and understand the risks involved. By choosing the right stocks, using a reliable brokerage firm, and staying informed about market trends, you can unlock the potential of the US stock market and grow your investment portfolio. Remember, investing is a long-term endeavor, and patience and discipline are key to success.

us stock market today live cha

like

- 2026-01-15Title: US Election Results and Their Impact on the Stock Market

- 2026-01-18US Momentum Stocks: Top Performers Over the Past 5 Days in August 2025

- 2026-01-15Understanding the US Dollar Stock Symbol: A Comprehensive Guide

- 2026-01-20JPMorgan's Dimon Warns of Inflated US Stock Market

- 2026-01-18Top Momentum US Stocks Today: A Deep Dive into the Market's Hot Picks

- 2026-01-16Title: US Blue Chip Stocks 2016: A Comprehensive Overview

- 2026-01-20How Major US Stock Indexes Fared on April 8, 2025"

- 2026-01-15How to Buy US OTC Stocks in the UK

- 2026-01-18QCOM US Stock Price: What You Need to Know

- 2026-01-17Hot US Stocks to Watch in July 2025