Is the Stock Market Plummeting?

In recent weeks, the stock market has been experiencing significant fluctuations, sparking concerns about a potential plummet. This article delves into the reasons behind these market shifts and offers insights into how investors can navigate through such turbulent times.

Understanding the Market Downturn

Several factors have contributed to the current market uncertainty. The most notable include global economic uncertainty, rising interest rates, and the lingering effects of the COVID-19 pandemic. Global economic uncertainty has been heightened by the ongoing tensions between major economies, particularly the US and China. These tensions have led to concerns about trade wars and the potential impact on global supply chains.

Rising Interest Rates

The Federal Reserve's decision to raise interest rates has also played a significant role in the market downturn. Higher interest rates can make borrowing more expensive for companies, which can lead to lower earnings and, consequently, lower stock prices. Rising interest rates can also impact consumer spending, which is a major driver of economic growth.

COVID-19 Pandemic's Lingering Effects

The COVID-19 pandemic has had a lasting impact on the stock market. The initial market downturn was driven by fears of a global recession, but as vaccines became available, investors hoped for a recovery. However, the pandemic's effects have continued to linger, with concerns about variants and their potential impact on economic activity.

Navigating Turbulent Times

For investors, navigating the stock market during a downturn can be challenging. Here are some strategies to consider:

- Diversify Your Portfolio: Diversification can help mitigate risk by spreading your investments across different asset classes, sectors, and geographic regions.

- Maintain a Long-Term Perspective: It's important to remember that market downturns are a normal part of the investing cycle. Maintaining a long-term perspective can help you stay focused on your investment goals and avoid making impulsive decisions based on short-term market fluctuations.

- Stay Informed: Keeping up with the latest market news and trends can help you make more informed investment decisions. However, be cautious of market speculation and the influence of social media on market sentiment.

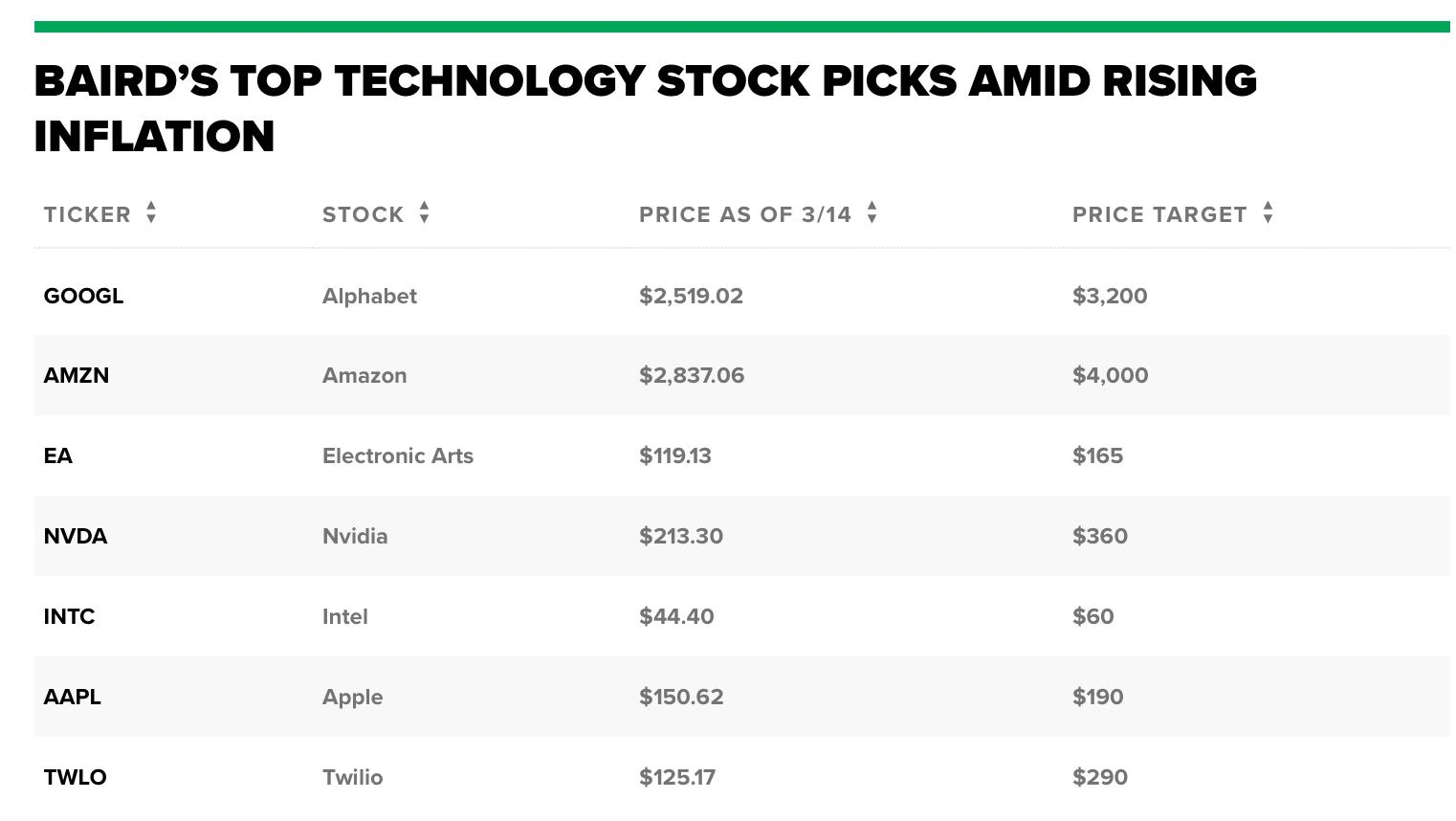

Case Study: Tech Stocks and the Downturn

One of the sectors most affected by the recent market downturn has been the technology industry. Tech stocks had been on a tear for years, but they have experienced significant declines in recent months. This can be attributed to a variety of factors, including concerns about valuation and the potential for regulatory changes.

While the current market environment may be challenging, it's important to remember that the stock market has historically recovered from downturns. By staying informed and adopting a long-term perspective, investors can navigate through turbulent times and achieve their financial goals.

api us stock

like

- 2026-01-15Title: AI Market Shock May Spark Broader US Stock Gains

- 2026-01-16Stock Markets in the US Today: A Comprehensive Overview

- 2026-01-22Understanding US Railway Stock Symbols: A Comprehensive Guide

- 2025-12-31Pharmaceutical Stocks: A Lucrative Investment Opportunity in a Health-Centric World

- 2026-01-23US Cellular Stock Analysis: A Comprehensive Guide to Current Trends and Future Prospects

- 2026-01-20Unlock Exclusive Adidas Stock with Tools YZY.io: The Ultimate Adidas-Stock-Checker Pid B37572 & Region Us Solution

- 2026-01-17Title: US Bank Stock Price Forecast: What to Expect in 2023

- 2026-01-20US Stock Market 2019 Outlook: A Comprehensive Analysis

- 2026-01-17Can China Buy US Stock? Understanding the Investment Landscape

- 2026-01-22Us Stock Marijuana: The Growing Trend in Legalized Cannabis