Oil Refinery Stocks: A Strategic Investment in the Energy Sector

In the dynamic world of energy, investing in oil refinery stocks can be a strategic move for investors looking to capitalize on the oil and gas industry. With the rise in demand for refined petroleum products and the increasing focus on energy efficiency, the oil refining sector has emerged as a promising area for investment. This article delves into the key aspects of oil refinery stocks in the United States, providing insights into the market trends and potential opportunities.

Understanding the Oil Refining Industry

The oil refining industry is a critical link in the supply chain of the energy sector. Refineries take crude oil and process it into various products such as gasoline, diesel, jet fuel, and lubricants. The U.S. is one of the world's largest oil refining countries, with numerous refineries spread across the nation.

Market Trends and Opportunities

Growing Demand for Refined Products: As the global economy continues to grow, so does the demand for refined products. This trend is expected to persist, making oil refinery stocks a favorable investment.

Shale Oil Revolution: The U.S. shale oil revolution has significantly impacted the refining industry. With the increase in domestic crude oil production, refineries are processing more American crude oil, reducing reliance on imported oil.

Regulatory Environment: The U.S. government's regulatory framework plays a crucial role in the oil refining industry. Investors should stay informed about any changes in regulations that could impact the sector.

Innovation and Efficiency: Refineries are continually investing in technology and innovation to improve efficiency and reduce costs. This focus on efficiency can lead to increased profitability and better returns for investors.

Top Oil Refinery Stocks in the U.S.

Exxon Mobil Corporation (XOM): As one of the largest publicly traded oil and gas companies, Exxon Mobil operates refineries worldwide, including several in the U.S.

Chevron Corporation (CVX): Chevron is another leading player in the oil refining industry, with a significant presence in the U.S. and globally.

Valero Energy Corporation (VLO): Valero is a leading independent refiner with a strong footprint in the U.S. The company's focus on efficiency and innovation has made it a popular investment choice.

Phillips 66 (PSX): Phillips 66 is a diversified energy company with a strong focus on refining. The company operates refineries in the U.S. and internationally.

Case Study: Valero Energy Corporation

Valero Energy Corporation is a prime example of a successful investment in the oil refining industry. The company has a diversified portfolio of assets, including refineries, pipelines, and terminals. Valero's focus on operational efficiency and strategic investments has led to consistent growth and profitability. In recent years, the company has invested heavily in upgrading its refineries to process more domestic crude oil, enhancing its competitive advantage.

Conclusion

Investing in oil refinery stocks can be a rewarding venture for those looking to capitalize on the energy sector. With growing demand for refined products, technological advancements, and a favorable regulatory environment, the U.S. oil refining industry presents numerous opportunities. By carefully selecting stocks in this sector, investors can potentially achieve significant returns on their investments.

api us stock

like

- 2025-12-31Tech Stocks to Buy: Top Picks for 2023

- 2026-01-15Title: 2018 US Stock Market Chart: A Comprehensive Analysis

- 2026-01-16Analyst Upgrades Stocks: A Game-Changing Move for Investors in the US

- 2026-01-16Meituan Dianping Stock in US: A Comprehensive Analysis

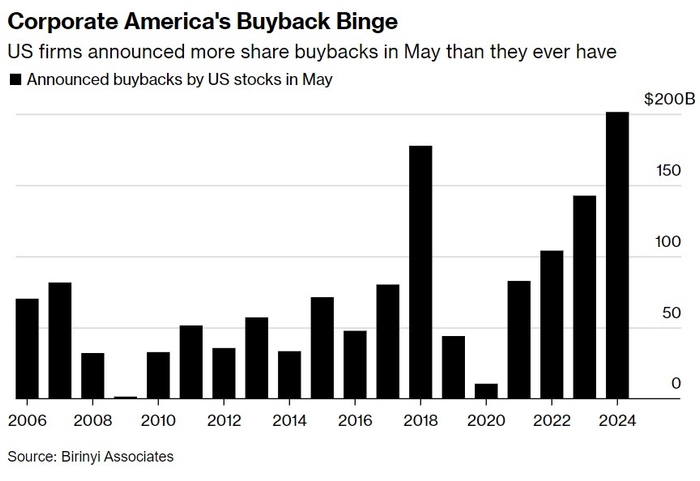

- 2025-12-31Stock Buybacks: A Strategic Move for Investors and Companies

- 2026-01-16Title: "US Economic News Affecting South Korea Stock Market in May 2025"

- 2025-12-31After Hours Trading: Unlocking the Potential of Extended Trading Hours

- 2026-01-16Cement Companies Stock US: A Comprehensive Guide to Investing in the Concrete Industry

- 2026-01-16Best Broker to Trade US Stocks: Unveiling the Ultimate Choice

- 2026-01-15Best Performing US Stocks: Recent Performance and Analysis