Stock Market US Holiday: Understanding the Impact on Trading

In the United States, the stock market is one of the most dynamic and influential financial markets in the world. However, it operates on a specific schedule, and certain holidays can significantly impact trading activities. This article delves into the significance of stock market holidays in the US, their impact on trading, and what investors should know.

Understanding Stock Market Holidays in the US

The stock market in the US is typically open from 9:30 AM to 4:00 PM Eastern Time, Monday through Friday. However, there are several holidays when the market is closed, and these include:

- New Year's Day

- Martin Luther King Jr. Day

- Presidents' Day

- Good Friday

- Memorial Day

- Independence Day

- Labor Day

- Thanksgiving Day

- Christmas Day

These holidays are observed to honor important events and figures in American history and culture. While the market is closed on these days, it's crucial for investors to understand the implications of these closures.

Impact on Trading

When the stock market is closed, it can affect trading in several ways:

- Liquidity: The lack of trading activity on holidays can lead to lower liquidity in the market. This means that it may be more challenging to buy or sell securities at desired prices.

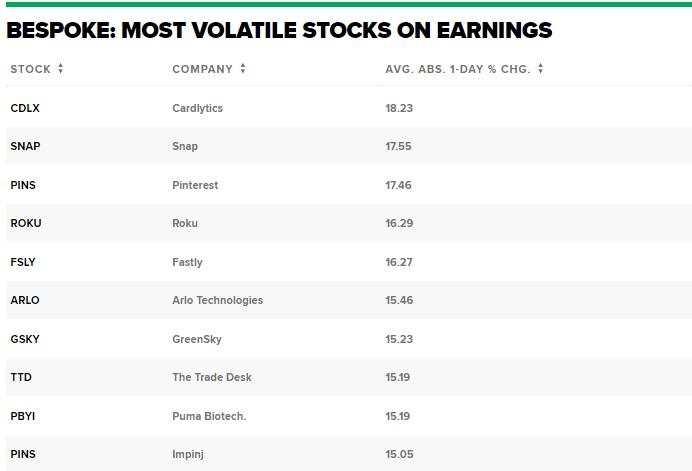

- Price Volatility: The stock market is closed for several days during the year, and this can lead to higher price volatility when trading resumes. This is because there may be significant news events or economic data releases during the holiday period that can impact market sentiment.

- Investment Opportunities: Investors may miss out on potential investment opportunities if they are not monitoring the market closely during holidays.

Case Studies

One notable example of the impact of stock market holidays on trading is the "Flash Crash" of 2010. This event occurred on May 6, 2010, and was sparked by a rapid decline in stock prices that was not immediately understood. Many investors were unable to trade due to the holiday weekend, which followed the event, and this contributed to the confusion and panic that ensued.

Another example is the impact of the COVID-19 pandemic on the stock market. The market closed for a day on March 16, 2020, due to concerns about the spread of the virus. This closure allowed the market to stabilize before trading resumed, minimizing the potential for further panic.

What Investors Should Know

To navigate the impact of stock market holidays on their investments, investors should:

- Stay Informed: Keep up-to-date with market news and economic indicators leading up to and following holidays.

- Diversify Investments: Diversifying your portfolio can help mitigate the risk of market volatility during holidays.

- Plan Ahead: Consider your investment strategy in advance and be prepared for potential market disruptions during holidays.

In conclusion, understanding the impact of stock market holidays in the US is crucial for investors. While these holidays are observed to honor important events and figures, they can also affect trading activities and market sentiment. By staying informed and planning ahead, investors can navigate these challenges and make informed investment decisions.

api us stock

like

- 2026-01-18Title: How Much is 1 Penny US Dollars in the Stock Market Today?

- 2026-01-17Short-Term Bullish US Stocks: Opportunities in the Market

- 2026-01-18Kyle Brown Option Strategy on US Stocks: A Comprehensive Guide

- 2026-01-15PFIZER US HEALTHCARE STOCKS: A Comprehensive Analysis

- 2025-12-31ARM Stocks: A Guide to Understanding and Investing in ARM Holdings

- 2026-01-17Title: The Impact of the US-China Trade War on the US Stock Market

- 2025-12-31Cybersecurity Stocks: The Digital Shield Against Cyber Threats

- 2026-01-18US Stock Futures Current Status: Key Trends and Analysis

- 2026-01-15Tencent Stock US: A Comprehensive Analysis

- 2025-12-31Best Performing Stocks: How to Identify and Invest in Them