Stock Performance in the US: A Comprehensive Analysis

In today's dynamic financial landscape, understanding the stock performance in the US is crucial for investors and market enthusiasts alike. This article delves into the key factors influencing stock performance, the impact of market trends, and provides a comprehensive analysis of the current market scenario. By examining historical data and recent developments, we aim to offer valuable insights into the stock market's performance in the US.

Historical Stock Performance

The US stock market has a long and storied history, characterized by periods of both growth and downturn. Over the past century, the market has experienced several bull and bear markets, with the most notable being the Great Depression, the dot-com bubble, and the 2008 financial crisis.

One of the most significant factors contributing to stock performance in the US has been technological innovation. Companies like Apple, Microsoft, and Google have revolutionized various industries, leading to substantial growth in their stock prices. Similarly, the rise of e-commerce platforms like Amazon has had a profound impact on the stock market.

Market Trends and Factors Influencing Stock Performance

Several factors influence stock performance in the US, including economic indicators, corporate earnings, geopolitical events, and market sentiment. Here are some key trends and factors to consider:

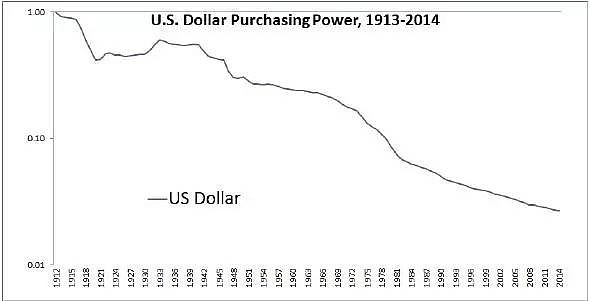

Economic Indicators: Economic indicators such as GDP growth, unemployment rates, and inflation rates play a crucial role in shaping stock performance. A strong economy typically leads to higher stock prices, while a weak economy can result in lower stock prices.

Corporate Earnings: The financial performance of companies directly impacts their stock prices. Positive earnings reports can drive stock prices higher, while negative reports can lead to a decline in stock prices.

Geopolitical Events: Geopolitical events, such as trade wars, political instability, and conflicts, can significantly impact the stock market. For instance, the trade tensions between the US and China in recent years have caused volatility in the stock market.

Market Sentiment: Market sentiment refers to the overall attitude of investors towards the market. Optimism can drive stock prices higher, while pessimism can lead to a decline in stock prices.

Recent Developments and Current Market Scenario

In recent years, the US stock market has experienced a significant bull run, with the S&P 500 index reaching record highs. However, this bull run has been accompanied by increased volatility and uncertainty.

One of the key drivers of this bull run has been the Federal Reserve's accommodative monetary policy, which has kept interest rates low and supported the stock market. Additionally, the strong performance of tech stocks, particularly in the wake of the COVID-19 pandemic, has contributed to the overall market growth.

However, the current market scenario is fraught with challenges. The global economic recovery remains uncertain, and the possibility of a recession cannot be ruled out. Moreover, the rising inflation and supply chain disruptions have raised concerns about the sustainability of the current bull run.

Case Studies

To illustrate the impact of various factors on stock performance, let's consider a few case studies:

Apple Inc.: Apple's stock has seen significant growth over the past decade, driven by its strong financial performance and innovative products. However, the company's stock has experienced volatility due to geopolitical events and market sentiment.

Tesla Inc.: Tesla's stock has been one of the most volatile in the US stock market. The company's strong growth and innovative approach have attracted investors, but concerns about its financial stability and regulatory challenges have also caused stock price fluctuations.

NVIDIA Corporation: NVIDIA's stock has experienced substantial growth due to its leadership in the semiconductor industry. The company's strong financial performance and growing demand for its products have contributed to its stock's rise.

In conclusion, understanding the stock performance in the US requires a comprehensive analysis of various factors, including economic indicators, corporate earnings, geopolitical events, and market sentiment. By staying informed and adapting to changing market conditions, investors can make more informed decisions and navigate the complexities of the stock market.

api us stock

like

- 2025-12-31Cybersecurity Stocks: The Digital Shield Against Cyber Threats

- 2026-01-13US Stock Futures Fall: What It Means for Investors

- 2025-12-31Copper Stocks: The Investment Opportunity You Can't Ignore

- 2026-01-15Is the US Stock Market Open on Friday After Thanksgiving?

- 2026-01-16http stocks.us.reuters.com stocks fulldescription.asp rpc 66&symbol elos.o: A Deep Dive into Elos Technologies Stock

- 2026-01-15Title: Us Stock Graphs: A Comprehensive Guide to Understanding Stock Market Trends

- 2025-12-31Chevron Dividend: A Comprehensive Guide to Understanding and Maximizing Returns

- 2026-01-16Title: Best US Stocks to Buy Today: A Comprehensive Analysis

- 2026-01-15Important Dates for Us Stock Market

- 2026-01-15Understanding the PE Ratio of the U.S. Stock Market