Technical Analysis of US Stocks in October 2025: A Comprehensive Guide

Introduction

In the ever-evolving world of finance, staying ahead of the curve is key to successful investments. As we approach October 2025, it's crucial for investors to understand the latest trends and techniques in technical analysis for US stocks. This article aims to provide a comprehensive guide to help you navigate the stock market with confidence and precision.

Understanding Technical Analysis

Technical analysis is a method of evaluating securities by analyzing statistics generated by market activity, such as trading volume and price movements. By studying these patterns, investors can identify potential buy and sell signals, which can help them make informed decisions.

Key Indicators for October 2025

Moving Averages: Moving averages (MAs) are a popular tool for technical analysis. They smooth out price data to identify the trend direction. In October 2025, investors should pay close attention to the 50-day and 200-day MAs, as they can indicate the long-term trend.

Relative Strength Index (RSI): The RSI is a momentum oscillator that measures the speed and change of price movements. A reading above 70 suggests that a stock may be overbought, while a reading below 30 indicates it may be oversold.

Bollinger Bands: Bollinger Bands consist of a middle band being an MA, with upper and lower bands being standard deviations away from the middle band. This indicator helps identify the volatility and potential overbought/oversold levels.

Volume: Trading volume is a critical indicator that shows the number of shares being traded. High volume often confirms the strength of a trend, while low volume can indicate a lack of interest.

Stock Selection in October 2025

Technology Sector: The technology sector has been a significant driver of the US stock market for years. Companies like Apple, Microsoft, and Google are expected to continue their growth trajectory in October 2025.

Healthcare Industry: With an aging population and advancements in medical technology, the healthcare industry is poised for growth. Companies like Johnson & Johnson and Pfizer are potential investments.

Energy Sector: The energy sector has seen a surge in recent years, driven by the transition to renewable energy sources. Companies like Tesla and BP are leading the charge.

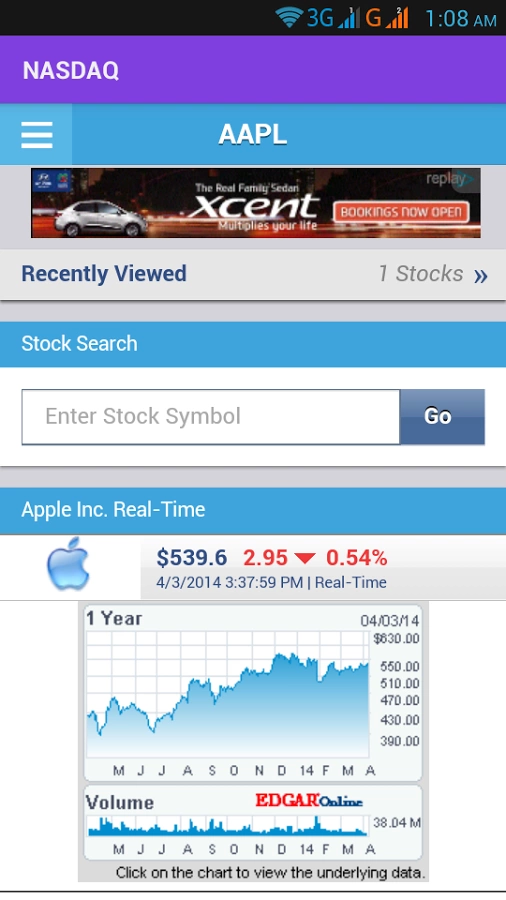

Case Study: Apple Inc.

Let's take a look at a case study involving Apple Inc. (AAPL) in October 2025.

- Moving Averages: The 50-day MA is above the 200-day MA, indicating a bullish trend.

- RSI: The RSI is around 60, suggesting that the stock is neither overbought nor oversold.

- Bollinger Bands: The stock is trading within the middle band, indicating a stable trend.

- Volume: The trading volume is high, confirming the strength of the trend.

Based on these indicators, Apple Inc. appears to be a strong investment opportunity in October 2025.

Conclusion

Technical analysis is a powerful tool for investors looking to make informed decisions in the stock market. By understanding key indicators and staying up-to-date with market trends, you can navigate the complexities of the US stock market with confidence. As we approach October 2025, it's crucial to stay vigilant and adapt to the ever-changing landscape of the financial world.

api us stock

like

- 2025-12-31Stock Market Forecast 2025: What to Expect and How to Prepare

- 2025-12-31International ETFs: A Guide to Diversifying Your Portfolio

- 2025-12-31Covered Calls: A Strategic Approach to Enhancing Portfolio Returns

- 2025-12-31Railroad Stocks: A Strategic Investment for the Future

- 2025-12-31Oil Stocks: A Strategic Investment for Energy-Savvy Investors

- 2025-12-31Biotech Stocks: The Future of Innovation and Investment

- 2025-12-31Electric Vehicle Stocks: A Golden Opportunity in the Green Revolution

- 2025-12-31The Power of Quant Trading: Revolutionizing the Financial Markets

- 2025-12-31Index Fund vs ETF: Understanding the Key Differences

- 2025-12-31Recession Proof Stocks: Your Shield Against Economic Uncertainties