Trading U.S. Stocks in South Africa: A Comprehensive Guide

Embarking on the journey of trading U.S. stocks from South Africa can be an exciting venture for investors seeking diverse investment opportunities. However, navigating this complex market requires a clear understanding of the nuances involved. In this comprehensive guide, we'll delve into the key aspects you need to consider before venturing into trading U.S. stocks from South Africa.

Understanding the Market

First and foremost, it's essential to understand the market you're about to enter. The U.S. stock market, with its diverse range of stocks and ETFs, is one of the largest and most influential in the world. South African investors have access to a plethora of American companies through various platforms.

Choosing the Right Broker

The choice of a broker is critical when trading U.S. stocks from South Africa. A reliable broker with experience in international trading is crucial for a seamless experience. Ensure your broker offers competitive fees, robust security measures, and access to a wide range of U.S. stocks. Some popular brokers include TD Ameritrade, E*TRADE, and Fidelity.

Understanding U.S. Market Hours

It's vital to be aware of the U.S. market hours. The primary trading hours for U.S. stocks are from 9:30 a.m. to 4:00 p.m. Eastern Standard Time (EST). However, pre-market and after-hours trading sessions are also available. Timing your trades correctly is essential for maximizing profits.

Tax Considerations

When trading U.S. stocks from South Africa, tax considerations play a significant role. South African investors need to understand the tax implications of trading U.S. stocks, including capital gains tax and dividend tax. Consult with a tax professional to ensure compliance with both South African and U.S. tax laws.

Risk Management

Trading stocks carries inherent risks, and managing these risks is crucial for long-term success. Implementing risk management strategies such as diversification, stop-loss orders, and position sizing is essential. Educating yourself on technical and fundamental analysis can help you make informed decisions.

Case Study: Investing in Tech Stocks

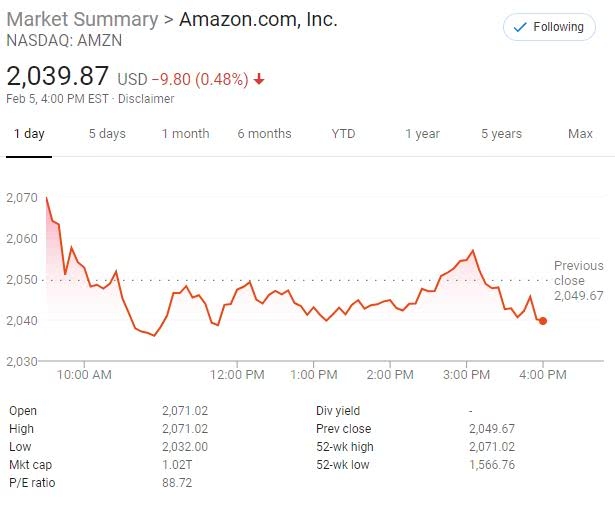

To illustrate the potential of trading U.S. stocks from South Africa, let's consider the tech sector. In recent years, technology stocks have dominated the U.S. market, with giants like Apple, Amazon, and Microsoft leading the charge. A South African investor who identified this trend early and invested in these stocks would have experienced significant growth in their portfolio.

Conclusion

Trading U.S. stocks from South Africa offers numerous opportunities for investors seeking to diversify their portfolios. By understanding the market, choosing the right broker, and managing risks effectively, South African investors can navigate this complex market and potentially reap substantial rewards. Always seek professional advice and conduct thorough research before making investment decisions.

api us stock

like

- 2026-01-17Understanding the RF US Stock Price: What You Need to Know

- 2026-01-22How Often Can You Trade at the US Stock Market?"

- 2026-01-22PJapan Stock Market Discount to US: Unveiling the Investment Opportunity"

- 2026-01-22Best Performing US Large Cap Stocks: Momentum and Analysis from the Past Week"

- 2025-12-31Earnings Whisper: The Secret Weapon for Investors

- 2026-01-23What Are Stock Futures Doing Today? A Comprehensive Update"

- 2026-01-15Publicly-Traded on a US Stock Exchange: A Comprehensive Guide

- 2026-01-17http stocks.us.reuters.com stocks fulldescription.asp rpc 66&symbol kalu.o: An In-Depth Look into Kalu Inc.

- 2026-01-16Meituan Dianping Stock in US: A Comprehensive Analysis

- 2026-01-17Title: Federal 210 Primers in Stock: Your Ultimate Guide to High-Quality Firearm Accessories