US Stock Futures Rise: What It Means for Investors

The stock market is a dynamic entity, constantly shifting with the tides of economic news, corporate earnings, and geopolitical events. One of the most telling indicators of market sentiment is the movement of stock futures. In this article, we'll delve into what it means when US stock futures rise, and how it can impact investors.

Understanding Stock Futures

Stock futures are financial contracts that allow investors to buy or sell a stock at a predetermined price at a future date. They are often used as a hedge against potential losses or as a way to speculate on the future price of a stock. When stock futures rise, it suggests that investors are optimistic about the future performance of the underlying stock.

Factors Contributing to Rising Stock Futures

Several factors can contribute to the rise in stock futures:

- Positive Economic News: When the economy is performing well, investors tend to be more optimistic about the future. This can lead to an increase in stock futures as investors anticipate higher corporate earnings and economic growth.

- Corporate Earnings Reports: Strong earnings reports from companies can boost stock futures. If a company exceeds expectations, it can signal that the overall market is performing well.

- Geopolitical Stability: When the geopolitical landscape is stable, investors are more likely to invest in the stock market. This can lead to a rise in stock futures as investors feel more secure about their investments.

Impact on Investors

When stock futures rise, it can have several implications for investors:

- Potential for Higher Returns: If the underlying stock performs well, investors who bought the futures contract at a lower price can make a profit when the stock rises.

- Increased Volatility: When stock futures rise, it can lead to increased volatility in the stock market. This can be beneficial for investors who are looking to capitalize on price movements, but it can also be risky.

- Opportunity for Speculation: Investors who are bullish on the market can use stock futures as a way to speculate on the future price of a stock without owning the actual stock.

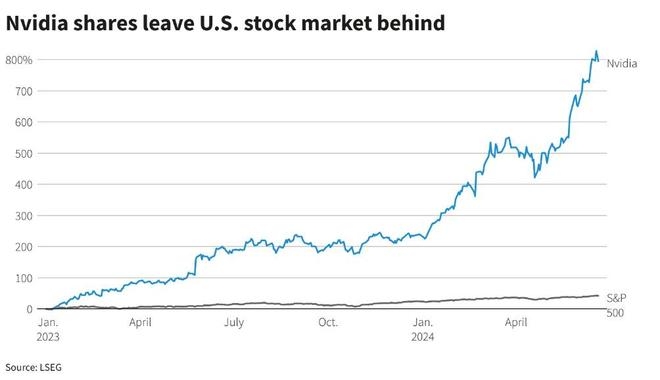

Case Study: The S&P 500 Futures

One of the most closely watched stock futures is the S&P 500 futures. When these futures rise, it often indicates a positive outlook for the overall market. For example, in early 2021, the S&P 500 futures rose significantly after the election of a new president. This was seen as a sign that the market was optimistic about the potential for economic growth and corporate earnings.

Conclusion

When US stock futures rise, it is a sign of optimism in the market. While it can present opportunities for investors, it is important to understand the underlying factors driving the rise and to be aware of the potential risks. By staying informed and making informed decisions, investors can navigate the stock market with confidence.

api us stock

like

- 2025-12-31Target Date Fund: Your Ultimate Guide to Retirement Investment

- 2025-12-31Warren Buffett Stocks: The Secret to Investment Success

- 2025-12-31Regional Bank Stocks: The Hidden Gems of the Financial Market

- 2026-01-13Can Non-US Citizens Invest in Stocks?

- 2025-12-31Index Fund vs ETF: Understanding the Key Differences

- 2025-12-31Top ETFs: Your Guide to Diversifying Your Portfolio

- 2025-12-31High-Frequency Trading: The Modern Art of Rapid Fire Investing

- 2025-12-31Understanding Vesting Schedules: A Comprehensive Guide

- 2025-12-31Investor Day: Unveiling the Future of Investment Opportunities

- 2026-01-15Best US Bank Stocks to Watch in 2022