US and Europe Stocks Rally After Turmoil

Introduction: In the wake of recent global turmoil, investors have been on edge, looking for signs of stability. However, a remarkable rally in both US and European stocks has emerged, providing a glimmer of hope for the future. This article explores the factors behind this unexpected surge and examines the potential implications for investors.

Rally in US Stocks: The US stock market has been on a rollercoaster ride in recent months, with several major market indices hitting record highs. One of the key factors behind this rally has been the Federal Reserve's decision to keep interest rates low. This has encouraged investors to seek higher returns in the stock market, rather than in fixed-income securities.

Another significant factor has been the strong economic data released by the US government. According to the latest data, the US economy grew at an annual rate of 2.6% in the second quarter of 2019, driven by consumer spending and business investment. This strong economic growth has boosted investor confidence and driven up stock prices.

Rally in European Stocks: Similarly, European stocks have also seen a significant rally in recent weeks. The European Central Bank (ECB) has been playing a crucial role in this rally, by keeping interest rates low and implementing quantitative easing measures. These measures have helped to stimulate economic growth in the region and boost investor sentiment.

In addition, the European Union has taken steps to address some of the region's economic challenges, such as the Greek debt crisis. These measures have helped to restore investor confidence and drive up stock prices.

Emerging Markets: The rally in US and European stocks has also had a positive impact on emerging markets. Many emerging market economies are closely linked to the global economy, and the improved economic outlook in the US and Europe has helped to boost their growth prospects.

For example, China, the world's second-largest economy, has seen a significant increase in foreign investment and export orders. This has helped to boost the country's stock market and economic growth.

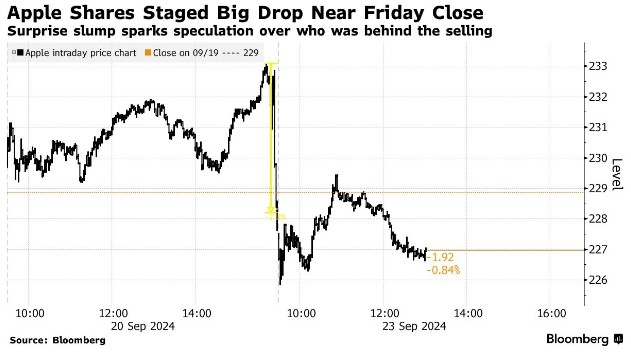

Case Study: One notable case study is the tech sector, which has seen a particularly strong rally in recent months. Companies such as Apple, Amazon, and Microsoft have all hit new all-time highs, driven by strong earnings reports and growing demand for their products and services.

Conclusion: The recent rally in US and European stocks has provided a welcome respite for investors who have been concerned about global economic turmoil. However, it is important to note that market conditions can change rapidly, and investors should be cautious about their investments. By staying informed and diversifying their portfolios, investors can navigate the volatile market landscape and achieve their financial goals.

api us stock

like

- 2026-01-18US Stock Market Astrology for 2024: Predictions and Insights

- 2025-12-31Market Outlook: Navigating the Future of Business Growth

- 2025-12-31Chevron Dividend: A Comprehensive Guide to Understanding and Maximizing Returns

- 2026-01-21Title: DeepSeek US Stock: The Future of Investment Technology

- 2025-12-31Utility Stocks: A Solid Investment for Long-Term Growth

- 2026-01-18How to Trade US Stocks from the Philippines

- 2026-01-22Tax on Foreigner-Owned US Stocks: Understanding the Implications and Strategies

- 2025-12-31Disney Earnings: A Closer Look at the Mouse's Financial Performance

- 2026-01-16Top US Stocks Pick Today: Your Guide to Investment Opportunities

- 2026-01-20eestor US Stock: A Deep Dive into the Future of Data Storage