DHT-US Stock Price: A Comprehensive Analysis

In today's volatile stock market, staying informed about the performance of key companies is crucial. One such company that has caught the attention of investors is DHT US Inc. (DHT-US). This article provides a detailed analysis of the DHT-US stock price, exploring its performance, factors influencing it, and future outlook.

Understanding the DHT-US Stock

DHT US Inc. is an American crude oil transportation and storage company based in Houston, Texas. The company operates a fleet of Very Large Crude Carriers (VLCCs) that transport oil from various producing regions to major refining centers around the world. With a strong focus on safety, reliability, and efficiency, DHT-US has become a key player in the global oil transportation industry.

Historical Performance

Over the past few years, the DHT-US stock price has experienced fluctuations due to various market factors. In the last five years, the stock has seen significant growth, with a high of

Factors Influencing the Stock Price

Oil Prices: Since DHT-US is involved in the oil transportation sector, the price of crude oil plays a crucial role in determining the company's profitability and, consequently, its stock price. As oil prices rise, so does the demand for DHT-US services, leading to an increase in the stock price.

Global Economic Conditions: Economic growth, particularly in major oil-consuming countries like China and the United States, can significantly impact oil demand and, by extension, the stock price of DHT-US.

Industry-Specific Developments: The oil transportation industry faces various challenges, such as increased competition and regulatory changes. These factors can also influence the stock price of DHT-US.

Future Outlook

Looking ahead, the future of the DHT-US stock price appears promising. Here are a few reasons why:

Rising Demand for Oil Transportation: With the global economy expected to recover in the coming years, the demand for oil transportation services is likely to increase, benefiting DHT-US.

Expansion Plans: DHT-US has been actively expanding its fleet and exploring new opportunities in the oil transportation sector. This expansion is expected to enhance the company's profitability and, in turn, its stock price.

Strategic Partnerships: The company has formed strategic partnerships with major oil producers and refiners, which can provide stability and growth opportunities.

Case Studies

To illustrate the impact of market factors on the DHT-US stock price, consider the following case studies:

Oil Price Volatility: In 2014, when oil prices crashed, the DHT-US stock price experienced a significant decline. However, as oil prices recovered, the stock price followed suit, showcasing the correlation between oil prices and the company's stock performance.

Expansion Initiatives: In 2018, DHT-US announced plans to expand its fleet. Following this announcement, the stock price experienced a sharp increase, reflecting investors' optimism about the company's growth prospects.

In conclusion, the DHT-US stock price is influenced by various factors, including oil prices, global economic conditions, and industry-specific developments. With a promising future outlook, investors looking to gain exposure to the oil transportation sector should consider DHT-US as a potential investment opportunity.

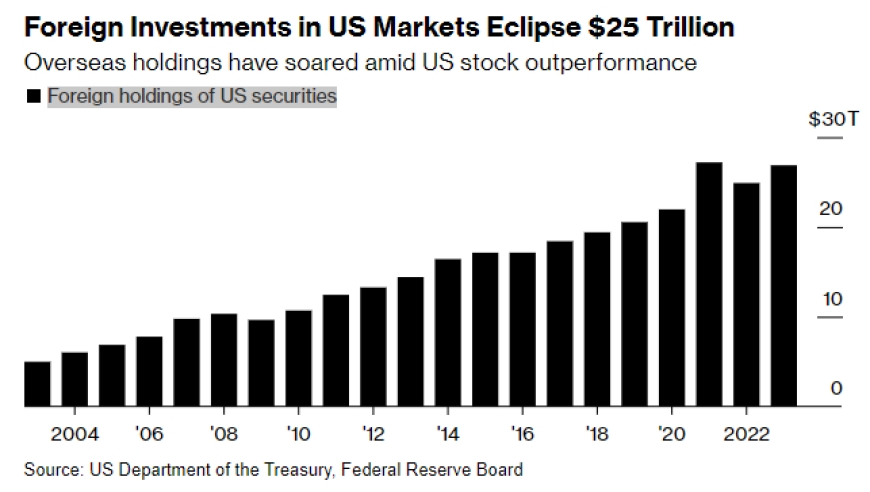

can foreigners buy us stocks

like

- 2026-01-04short interest

- 2026-01-04costco dividend

- 2026-01-15How Are the Things Doing on the US Stock Market?

- 2026-01-13Bank of America US Stock Price: What You Need to Know

- 2026-01-04oil stocks

- 2026-01-04starbucks stock

- 2026-01-15Best US Stock Market Podcasts: Your Ultimate Guide to Financial Insights

- 2026-01-15Title: AI-Related Stocks in the US Market: A Comprehensive Guide

- 2026-01-04socially responsible investing

- 2026-01-15Title: IA SBBI US Small Stock: Exploring the Potential of Undervalued Investments