Has the Stock Market Crashed? A Comprehensive Analysis

Introduction

In recent weeks, there has been a lot of buzz about the potential for a stock market crash. As investors and market enthusiasts alike grapple with the possibility, it's important to take a step back and analyze the current situation. This article will delve into the factors contributing to the uncertainty, provide a historical perspective, and offer insights into what investors should be considering moving forward.

Market Volatility and Economic Indicators

One of the primary concerns contributing to the notion of a stock market crash is increased market volatility. Market volatility refers to the degree of variation in trading prices over a specific period of time. In the past few months, we've seen a significant amount of volatility, which has caused many to question the stability of the market.

Several economic indicators have also raised concerns. For instance, the Consumer Price Index (CPI) has been rising, indicating inflationary pressures. Additionally, the Unemployment Rate has been fluctuating, which can impact consumer spending and corporate earnings.

Historical Perspective

It's important to remember that stock market crashes are not unprecedented. Throughout history, we've seen several major crashes, such as the 1929 Stock Market Crash and the 2008 Financial Crisis. While these events were devastating, they also provided opportunities for long-term investors to capitalize on undervalued assets.

The key difference between these crashes and the current market situation is the underlying economic factors. During the 1929 crash, the economy was experiencing rapid growth, but it was built on a foundation of speculative bubbles. Conversely, the 2008 crisis was triggered by the bursting of the housing bubble and subsequent credit crunch.

Current Market Analysis

The current market situation is complex, with a mix of positive and negative factors. On one hand, we have strong corporate earnings and a recovering economy. On the other hand, we have geopolitical tensions, rising inflation, and concerns about the global economy.

Case Studies

To better understand the potential impact of these factors, let's look at a few case studies:

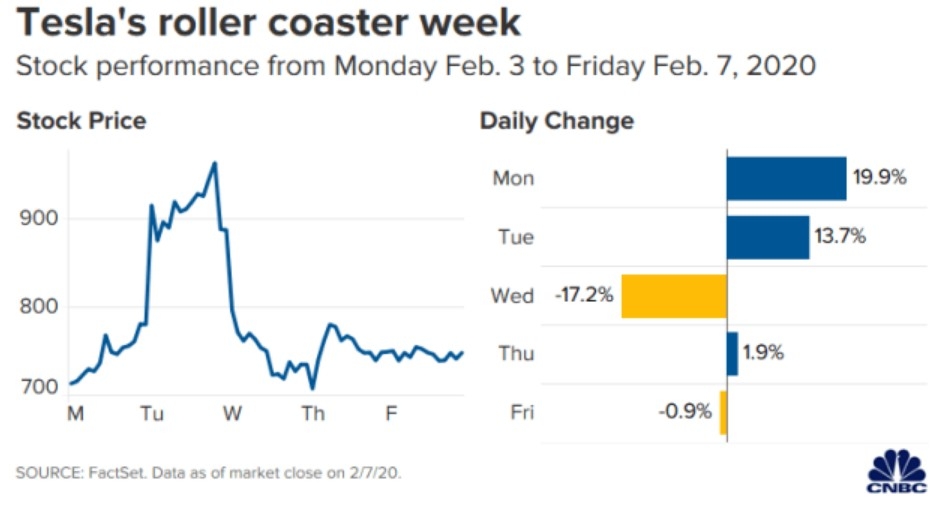

- Tesla (TSLA): Despite the overall market volatility, Tesla has managed to maintain its position as a leading player in the electric vehicle (EV) market. This can be attributed to the company's innovative approach and strong demand for its products.

- Apple (AAPL): Apple has been a consistent performer over the years, and its strong financial position has helped it navigate the current market environment. The company's focus on innovation and diversification has played a significant role in its resilience.

- Amazon (AMZN): Amazon has faced challenges in the past few months, including increased competition and supply chain disruptions. However, the company's strong market position and commitment to long-term growth have allowed it to overcome these obstacles.

Conclusion

While the possibility of a stock market crash cannot be ruled out, it's important to approach the current market situation with a balanced perspective. By understanding the factors contributing to uncertainty and analyzing historical trends, investors can make more informed decisions. Whether or not the stock market crashes, it's crucial to focus on long-term investing strategies and remain diversified to mitigate risk.

can foreigners buy us stocks

like

- 2026-01-04is now a good time to invest

- 2026-01-15US Stock Losses: Understanding the Impact and Mitigation Strategies

- 2026-01-15Title: US Gun Stock Inletting: The Art of Precision in Firearms Customization

- 2026-01-04adobe earnings

- 2026-01-04chip stocks

- 2026-01-15US Insurance Company Stocks: A Comprehensive Guide to Investing in the Insurance Sector

- 2026-01-04quant trading

- 2026-01-04subordinated debt

- 2026-01-13Best US Stocks Under $20: Top Picks for Investors Seeking Value

- 2026-01-15How Are the Things Doing on the US Stock Market?