Stocks on Computer: The Ultimate Guide to Trading and Investing

In today's digital age, the concept of stocks on computer has revolutionized the way we trade and invest. With just a few clicks, investors can access a vast array of financial markets and opportunities. This article delves into the ins and outs of trading stocks on a computer, covering everything from basic tools to advanced strategies. Whether you're a beginner or a seasoned investor, this guide will equip you with the knowledge to make informed decisions and maximize your returns.

Understanding the Basics

To get started with stocks on computer, it's crucial to understand the basics. Stocks represent ownership in a company, and investing in them can provide potential returns through dividends and capital gains. Trading involves buying and selling stocks with the aim of making a profit. This process can be done on a computer through various platforms, each offering unique features and tools.

Choosing the Right Platform

The first step in trading stocks on computer is selecting the right platform. There are numerous options available, ranging from brokerage websites to mobile apps. Each platform has its own set of features, fees, and user interface. It's essential to choose a platform that aligns with your investment goals and preferences. Some popular platforms include E*TRADE, TD Ameritrade, and Robinhood.

Understanding the Tools

Once you have a platform, familiarize yourself with the tools and resources available. Many platforms offer real-time stock quotes, charting tools, and news feeds. These tools can help you make informed decisions and stay updated with market trends. Additionally, some platforms offer research reports and financial calculators to assist you in analyzing potential investments.

Developing a Strategy

A successful trading strategy is essential for long-term success. Risk management is a key component of any strategy. It's important to understand your risk tolerance and allocate your investments accordingly. Some common strategies include day trading, Swing trading, and long-term investing.

Day Trading

Day trading involves buying and selling stocks within the same trading day. This strategy requires a high level of skill, discipline, and market knowledge. Day traders often use technical analysis to identify short-term trading opportunities. However, it's important to note that day trading can be risky and may not be suitable for all investors.

Swing Trading

Swing trading is a strategy that focuses on capturing short-term price movements over a few days to weeks. Swing traders use technical analysis and fundamental analysis to identify potential opportunities. This strategy requires a moderate level of risk tolerance and can be suitable for investors with a longer time horizon.

Long-Term Investing

Long-term investing involves holding stocks for an extended period, often years. This strategy requires a lower level of risk tolerance and can be suitable for investors with a long-term financial goal. Long-term investors often use fundamental analysis to identify companies with strong fundamentals and potential for growth.

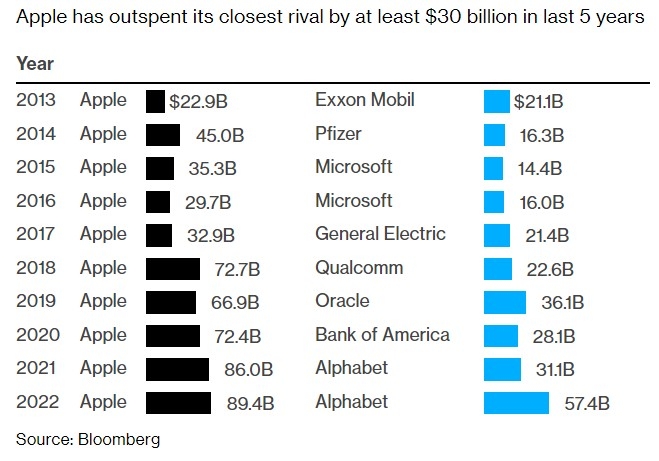

Case Study: Apple Inc.

Let's consider a hypothetical scenario involving Apple Inc. (AAPL). An investor who follows a long-term investing strategy may have purchased shares of Apple at

Conclusion

Trading stocks on computer has become an accessible and convenient way to invest in the stock market. By understanding the basics, choosing the right platform, and developing a solid strategy, you can increase your chances of success. Remember to stay informed, manage your risks, and adapt your strategy as needed. With the right approach, stocks on computer can be a powerful tool for building wealth.

can foreigners buy us stocks

like

- 2026-01-16Stocks Under $10 US: Finding Hidden Gems in the Market

- 2026-01-20Unlocking Opportunities: Indian Stocks in the US Market

- 2026-01-20US Fed Reserve's Influence on Stock Market Dynamics"

- 2026-01-07nasdaq 2022

- 2026-01-17Title: The Second Largest Stock Exchange in the US: A Comprehensive Guide

- 2026-01-18Can We Invest in US Stocks from India?

- 2026-01-16Title: Mexico-US Trade Stock: A Comprehensive Overview

- 2026-01-20Unveiling the US Nuclear Stock: Current Status, Implications, and Future Outlook"

- 2026-01-21Best US Stocks to Watch in 2024: A Comprehensive Guide

- 2026-01-20Penny Stocks News: US Market Insights Today