Total Value of US Stocks: A Comprehensive Overview

In the ever-evolving landscape of the global financial market, the total value of US stocks has always been a topic of great interest. This article delves into the current state of the US stock market, its historical trends, and the factors that influence its value.

Understanding the Total Value of US Stocks

The total value of US stocks, often referred to as the market capitalization, is the total worth of all publicly traded companies in the United States. It is calculated by multiplying the number of outstanding shares by the current market price of each share. This figure is a critical indicator of the overall health and performance of the US economy.

Historical Trends

Over the past few decades, the total value of US stocks has seen significant growth. In the early 1990s, the market capitalization was around

Factors Influencing the Total Value of US Stocks

Several factors contribute to the total value of US stocks. These include:

- Economic Growth: A strong economy typically leads to higher corporate earnings, which in turn drive up stock prices.

- Interest Rates: Lower interest rates can make stocks more attractive compared to bonds and other fixed-income investments, leading to higher stock prices.

- Corporate Earnings: Companies with strong earnings tend to see their stock prices rise, contributing to the overall market capitalization.

- Market Sentiment: Investor confidence and sentiment can significantly impact stock prices and the total value of the market.

Recent Developments

In recent years, the US stock market has experienced several major events that have influenced its total value. These include:

- The Great Recession: The global financial crisis of 2008 led to a significant decline in the total value of US stocks. However, the market quickly recovered and reached new highs.

- COVID-19 Pandemic: The pandemic initially caused a sharp decline in stock prices, but the market has since recovered and reached record highs.

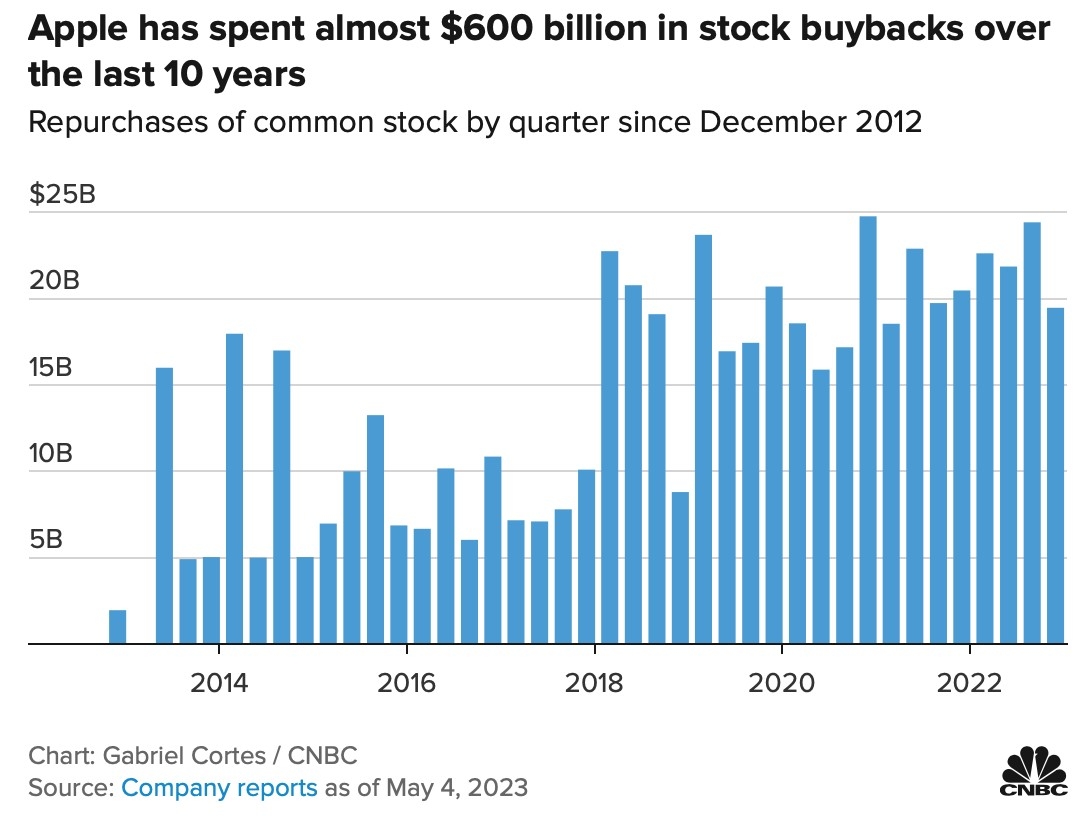

- Tech Stocks: The rise of tech stocks, particularly companies like Apple, Amazon, and Microsoft, has played a significant role in driving up the total value of US stocks.

Case Studies

One notable example is the rise of Tesla, a company that has seen its market capitalization skyrocket over the past few years. This has been driven by its strong growth, innovative products, and leadership in the electric vehicle market.

Conclusion

The total value of US stocks is a critical indicator of the health and performance of the US economy. Understanding the factors that influence this value can help investors make informed decisions. As the market continues to evolve, it will be interesting to see how the total value of US stocks changes in the coming years.

can foreigners buy us stocks

like

- 2026-01-16US Dollar Relation to Stock Market: A Comprehensive Analysis

- 2026-01-20Ukraine Russia US Stock Market: Impact and Investment Insights

- 2026-01-15Top Performing US Stocks: Weekly Momentum Analysis

- 2026-01-04consumer discretionary stocks

- 2026-01-15US Army Stocking: The Essential Guide to Military Fashion

- 2026-01-20US Stock Market Analysis: October 6, 2025 – Key Insights and Predictions

- 2026-01-18Stock Market Crash: Expert Sees U.S. Transitioning to Insolvency Phase

- 2026-01-17The Emerging US Marijuana Stock Exchange: A Game-Changing Market

- 2026-01-17How to Invest in US Stocks from India

- 2026-01-17Trading App for US Stocks: The Ultimate Guide to Streamlining Your Investment Experience