US Steel Stock Monthly History: A Comprehensive Overview

Investing in the stock market can be a daunting task, especially when it comes to analyzing the performance of individual stocks. One such stock that has captured the attention of many investors is US Steel (X). In this article, we delve into the monthly history of US Steel stock, providing a comprehensive overview of its performance over the years.

Understanding US Steel Stock

US Steel Corporation is one of the largest steel producers in the world, with operations in the United States, Canada, and Central Europe. The company's stock, ticker symbol X, is listed on the New York Stock Exchange. Understanding the monthly history of US Steel stock can help investors make informed decisions and identify potential opportunities.

Monthly Performance of US Steel Stock

Over the past decade, the performance of US Steel stock has been quite volatile. Let's take a closer look at its monthly history to understand the trends and patterns.

2010-2014: A Steady Rise

During the early 2010s, US Steel stock experienced a steady rise. This can be attributed to the recovery of the global economy and the subsequent increase in demand for steel. The stock reached its peak in May 2014, with a monthly closing price of around $40.

2015-2016: A Sharp Decline

However, the stock's upward trend came to a halt in 2015. A combination of factors, including the Chinese government's decision to cut steel production and the strong US dollar, led to a sharp decline in US Steel stock. The stock dropped to a low of around $23 in February 2016.

2017-2018: Recovery and Growth

In 2017, the stock started to recover, driven by a strong demand for steel in the US and abroad. This trend continued into 2018, with the stock reaching a new high of around $36 in October 2018.

2019-2020: A Volatile Year

The year 2019 was marked by a volatile performance for US Steel stock. The stock experienced several ups and downs, with a high of around

2021-2022: A Continued Trend

In 2021, US Steel stock continued to trend upwards, driven by strong demand and a favorable economic outlook. The stock reached a new high of around

Analyzing the Performance

Analyzing the monthly history of US Steel stock reveals several key insights:

- Volatility: US Steel stock has been quite volatile over the years, with several sharp ups and downs.

- Economic Factors: Economic factors such as trade tensions, global demand, and currency fluctuations have a significant impact on the stock's performance.

- Long-Term Growth: Despite the volatility, the stock has shown potential for long-term growth, especially during periods of strong economic activity.

Conclusion

Understanding the monthly history of US Steel stock can help investors make informed decisions and identify potential opportunities. By analyzing the trends and patterns, investors can gain insights into the factors that drive the stock's performance and make better investment decisions.

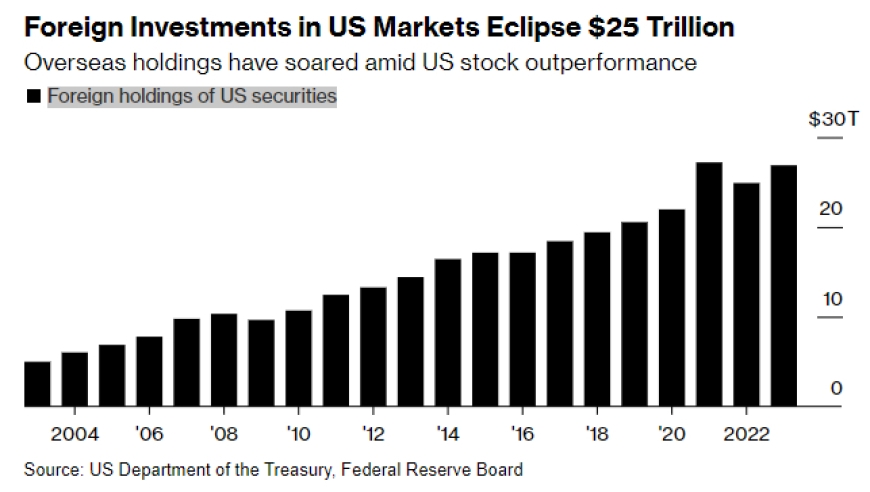

can foreigners buy us stocks

like

- 2026-01-22The Technologies US Stock Listing: A Comprehensive Guide

- 2026-01-20Complete List of US Stocks: A Comprehensive Guide

- 2026-01-20Botz US Stock: Revolutionizing the Way You Invest

- 2026-01-04cybersecurity stocks

- 2026-01-04investor day

- 2026-01-22Stocks to Benefit from US-China Trade Deal: Key Industries and Companies to Watch

- 2026-01-17Title: US Large Cap Stocks Momentum Analysis: Best Performing

- 2026-01-04snowflake stock

- 2026-01-20http stocks.us.reuters.com stocks fulldescription.asp rpc 66&symbol efv: Unveiling the Power of EFW Stock"

- 2026-01-21DeepSeek US Stock Market: Unveiling the Future of Investment Opportunities