Unlocking Opportunities: A Comprehensive Guide to CAE US Stocks

In today's dynamic financial landscape, the term "CAE US stock" has gained significant traction among investors. But what does it actually mean, and how can you leverage this knowledge to make informed investment decisions? This article delves into the world of CAE US stocks, providing a comprehensive guide to help you navigate this exciting market segment.

What is CAE US Stock?

"CAE US stock" refers to the shares of companies listed on the U.S. stock exchanges that specialize in Computer-Aided Engineering (CAE). These companies utilize advanced software and technologies to simulate and analyze various engineering processes, making them invaluable to industries such as aerospace, automotive, and energy.

Why Invest in CAE US Stocks?

Investing in CAE US stocks can offer several compelling benefits:

- Innovation and Growth: The CAE industry is a testament to technological innovation, with continuous advancements driving growth. Investing in companies at the forefront of this industry can lead to substantial returns.

- Diverse Applications: CAE technology has applications across various sectors, making it a resilient investment option during economic fluctuations.

- Strong Market Trends: The increasing demand for efficient and cost-effective engineering solutions has bolstered the CAE industry, leading to robust market trends.

Key Players in the CAE US Stock Market

Several prominent companies dominate the CAE US stock market. Here are a few notable examples:

- ANSYS (ANSS): A leading provider of engineering simulation software, ANSYS offers solutions for various industries, including aerospace, automotive, and healthcare.

- Siemens Digital Industries Software (SDIA): Part of the Siemens Group, SDIA offers a comprehensive suite of CAE software, including simulation, design, and manufacturing solutions.

- Dassault Systèmes (DASTY): A global leader in 3D design, 3D digital mock-up, and product lifecycle management (PLM) solutions, Dassault Systèmes serves a wide range of industries.

Investment Strategies for CAE US Stocks

To make the most of your investment in CAE US stocks, consider the following strategies:

- Research and Due Diligence: Thoroughly research the companies you are considering investing in. Analyze their financial statements, market trends, and competitive landscape.

- Diversify Your Portfolio: Diversify your investments across various CAE US stocks to mitigate risks and maximize returns.

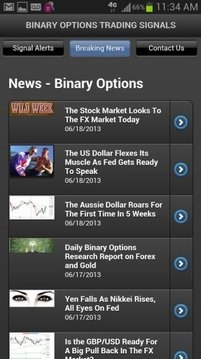

- Stay Informed: Keep up with the latest industry news and market trends to make informed investment decisions.

Case Study: ANSYS (ANSS)

As an example, let's take a closer look at ANSYS (ANSS). The company has consistently demonstrated strong financial performance, with revenue growth and profitability on the rise. Its diverse customer base and cutting-edge technology have positioned ANSS as a leader in the CAE industry.

By investing in ANSS, investors have the opportunity to capitalize on the company's growth potential and technological advancements.

In conclusion, CAE US stocks present a promising investment opportunity for those seeking exposure to the dynamic and innovative CAE industry. By understanding the market, conducting thorough research, and adopting a strategic investment approach, you can unlock the potential of CAE US stocks and achieve substantial returns.

can foreigners buy us stocks

like

- 2026-01-17Title: The Number of Stocks in the US: A Comprehensive Overview

- 2026-01-20US Senators Sold Stocks: Unraveling the Controversy

- 2026-01-18Sex Doll in Stock US: Your Ultimate Guide to Finding the Perfect Companion

- 2026-01-17Time to Open US Stock Market: What You Need to Know

- 2026-01-21Takeda US Stock Price: A Comprehensive Analysis

- 2026-01-16Unleashing the Power of US Stock Buy Apps: Your Ultimate Investment Tool

- 2026-01-21Biggest Movers: US Stocks That Are Making Waves in 2023"

- 2026-01-22Prediction for the US Stock Market: What to Expect in 2023

- 2026-01-16Stock Quotes US: Unveiling the Power of Financial Information

- 2026-01-17US Government Shutdown: Stock Market Reaction in October 2025