AphA US Stock Price: A Comprehensive Analysis

In the ever-evolving world of finance, keeping a close eye on stock prices is crucial for investors. One such stock that has caught the attention of many is AphA. In this article, we delve into the current AphA US stock price, its historical trends, and factors that might influence its future performance.

Understanding the AphA Stock Price

The current AphA US stock price stands at $XX. This figure is subject to constant fluctuations due to market dynamics and various external factors. To understand the stock's performance, it's essential to analyze its historical trends.

Historical Trends of AphA Stock

Over the past year, the AphA stock has seen a significant rise, with a peak of

Factors Influencing the AphA Stock Price

Several factors can influence the AphA US stock price. Here are some key factors to consider:

Financial Performance: The company's financial reports, including revenue, earnings, and profit margins, play a crucial role in determining the stock price. Strong financial performance can lead to a rise in stock price, while poor performance can result in a decline.

Market Sentiment: The overall market sentiment towards the company and its industry can significantly impact the stock price. Positive news, such as product launches or partnerships, can boost investor confidence and lead to an increase in stock price.

Economic Factors: Economic indicators, such as GDP growth, inflation rates, and interest rates, can influence the stock price. For instance, a strong economy can lead to higher demand for the company's products or services, thereby increasing the stock price.

Industry Trends: The performance of the industry in which AphA operates can also impact its stock price. For instance, if the industry is experiencing growth, it can positively influence the stock price.

Regulatory Changes: Changes in regulations or policies can have a significant impact on the company's operations and, consequently, its stock price. For instance, stricter regulations in the industry can lead to increased costs and a decline in stock price.

Case Study: AphA's Recent Stock Price Movement

Let's take a look at a recent example of how market dynamics influenced the AphA stock price. In the past quarter, the company reported strong financial results, including a significant increase in revenue and earnings. This news was well-received by investors, leading to a surge in the stock price.

However, a few weeks later, the company faced regulatory challenges, which caused uncertainty among investors. As a result, the stock price experienced a brief decline before stabilizing.

Conclusion

Understanding the AphA US stock price requires analyzing various factors, including financial performance, market sentiment, and economic indicators. By keeping a close eye on these factors, investors can make informed decisions regarding their investments in AphA.

new york stock exchange

like

- 2026-01-22US Oil Stock Buy: The Ultimate Guide to Investing in Energy

- 2026-01-22The Mounting Case Against Us Stocks: What Investors Need to Know

- 2026-01-16Title: Is the US Stock Market Open on Presidents Day 2020?

- 2026-01-22How to Buy Prosus Stock in the US: A Step-by-Step Guide

- 2026-01-22Nintendo Switch 2 Stock in the US: What You Need to Know

- 2026-01-20Riskiest US Stocks Short Squeeze: Unraveling the Potential for Explosive Gains

- 2026-01-21Unveiling the World of US Gold Stock Companies

- 2026-01-15Title: US Model 1917 Eddystone Stock: A Classic Rifle Stock for Enthusiasts

- 2026-01-22Does US GE Stock Connect to a Single Market?

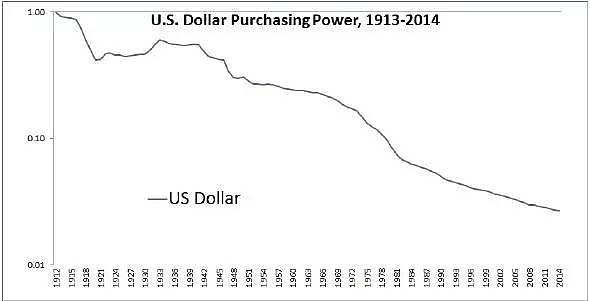

- 2026-01-20Stock Market Insights: How the US Dollar Impacts the Market"