August 6, 2025 US Stock Market Summary

The stock market is a dynamic landscape, where trends can shift overnight. As we delve into the August 6, 2025 US stock market summary, it's clear that investors are keeping a close eye on several key sectors and individual stocks. Here's a comprehensive breakdown of the day's activities.

Market Overview

The S&P 500 opened the day with a modest gain, bolstered by strong performance in the technology sector. However, as the trading session progressed, the market saw a slight pullback, primarily driven by concerns over global economic conditions and geopolitical tensions.

Key Sector Performances

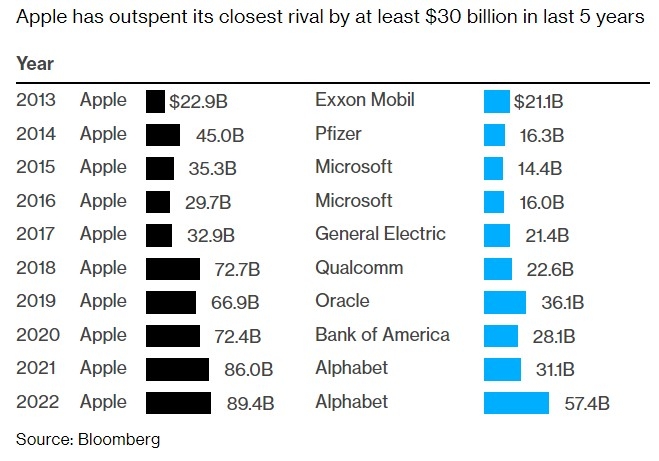

Technology: The tech sector was a standout performer, with companies like Apple and Microsoft posting significant gains. Apple saw a boost after announcing new product launches, while Microsoft benefited from a strong earnings report.

Energy: The energy sector experienced a mixed bag, with oil prices fluctuating throughout the day. Exxon Mobil saw a decline, while Chevron managed to hold its ground.

Healthcare: The healthcare sector was largely unchanged, with pharmaceutical companies like Pfizer and Merck experiencing modest gains.

Financials: The financial sector saw a mixed performance, with banks like JPMorgan Chase and Wells Fargo reporting mixed earnings results.

Individual Stock Highlights

Apple Inc. (AAPL): Shares of Apple surged after the company unveiled several new products, including a new iPhone and a refreshed MacBook Pro. The announcement sent the stock to new highs, with investors excited about the company's growth prospects.

Microsoft Corporation (MSFT): Microsoft's earnings report showcased strong performance across its various business segments, particularly in cloud computing. The company's commitment to innovation and expansion in new markets contributed to the stock's rise.

Exxon Mobil Corporation (XOM): Shares of Exxon Mobil fell as oil prices experienced a downward trend. Despite the decline, the company's strong position in the energy market ensured it remained relatively stable.

Geopolitical Tensions and Global Economic Concerns

The ongoing tensions in the Middle East and concerns about global economic growth continued to weigh on investor sentiment. While some sectors showed resilience, others remained cautious due to the uncertainty in the global market.

Case Study: Tesla, Inc. (TSLA)

Tesla, Inc., one of the most talked-about companies in the market, saw its shares fluctuate throughout the day. While the company announced a new battery production facility, investors were concerned about the company's increasing debt and competition in the electric vehicle (EV) market. Despite the uncertainty, Tesla's shares closed slightly higher, reflecting the company's ongoing influence on the stock market.

Conclusion

The August 6, 2025 US stock market summary revealed a mix of gains and losses across various sectors. While technology and energy sectors showcased strong performance, concerns over global economic conditions and geopolitical tensions kept investors cautious. As the trading session concluded, it was clear that the stock market remains unpredictable, with investors constantly seeking opportunities in a dynamic environment.

new york stock exchange

like

- 2026-01-18How to Trade on the US Stock Market: A Comprehensive Guide

- 2026-01-15Understanding US Stock Capitalization: A Comprehensive Guide

- 2026-01-16Is the US Stock Market Open This Friday? Everything You Need to Know

- 2026-01-15Psychedelic Stocks US: Exploring the Emerging Market

- 2026-01-18CAAS US Stock: Understanding the Cloud Access Security Broker Market

- 2026-01-16Us Remington Model 03-A3 Replacement Stocks: Enhancing Your Rifle's Performance

- 2026-01-16US Steel Stock Investigation: A Comprehensive Analysis

- 2026-01-15All Us Stocks: Your Ultimate Guide to the American Stock Market

- 2026-01-18Top Stocks to Buy Today: US Market Analysis

- 2026-01-18US Hot Stocks Forum: Your Ultimate Resource for Stock Market Insights