State Street US Large Company Stock Index: A Comprehensive Guide

In the vast landscape of the financial markets, the State Street US Large Company Stock Index stands as a vital benchmark for investors seeking to gauge the performance of the largest and most influential companies in the United States. This article delves into the intricacies of this index, its significance, and how it can be utilized to make informed investment decisions.

Understanding the State Street US Large Company Stock Index

The State Street US Large Company Stock Index, often referred to as the S&P 500, is a widely followed stock market index that tracks the performance of 500 large companies listed on stock exchanges in the United States. These companies represent a diverse range of sectors, including technology, healthcare, finance, and consumer goods, among others.

Key Features of the S&P 500

- Market Capitalization: The S&P 500 includes companies with a market capitalization of at least $10 billion, ensuring that only the largest and most influential companies are represented.

- Sector Representation: The index is designed to reflect the overall market, with no single sector dominating the composition. This diversification makes it a reliable indicator of market trends.

- Index Components: The S&P 500 is periodically reviewed and rebalanced to ensure that it remains representative of the market. Companies are added or removed based on their market capitalization and other factors.

Significance of the S&P 500

The S&P 500 is a crucial tool for investors due to several reasons:

- Market Performance Benchmark: The index serves as a benchmark for investors to compare the performance of their portfolios against the broader market.

- Economic Indicator: The S&P 500 is often used as an economic indicator, reflecting the overall health of the U.S. economy.

- Investment Strategy: Many investors use the S&P 500 as a basis for their investment strategies, seeking to gain exposure to a diversified portfolio of large-cap companies.

Utilizing the S&P 500 for Investment Decisions

Investors can leverage the S&P 500 in various ways:

- Index Funds: Investors can invest directly in the S&P 500 through index funds, which track the performance of the index and offer a cost-effective way to gain exposure to the largest U.S. companies.

- ETFs: Exchange-traded funds (ETFs) that track the S&P 500 provide investors with liquidity and the ability to trade throughout the trading day.

- Sector Rotation: Investors can use the S&P 500 to identify sectors that are performing well and allocate their investments accordingly.

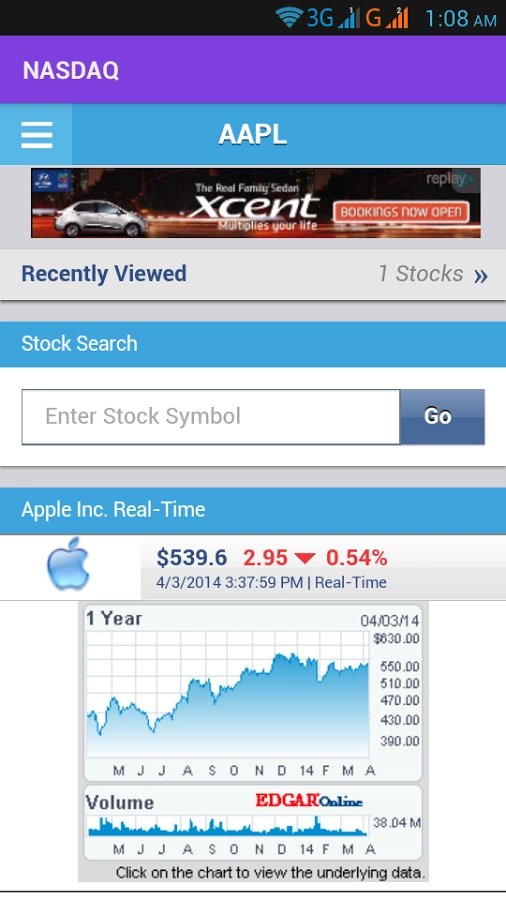

Case Study: Apple Inc.

Apple Inc., a technology giant, is a component of the S&P 500. By analyzing Apple's performance within the index, investors can gain insights into the company's growth potential and its impact on the broader market.

Conclusion

The State Street US Large Company Stock Index, or S&P 500, is a vital benchmark for investors seeking to understand the performance of the largest and most influential companies in the United States. By understanding the index's features and significance, investors can make informed decisions and capitalize on market trends.

new york stock exchange

like

- 2026-01-17US Optics B 10 In Stock: Your Ultimate Guide to Acquiring the Latest Gadget

- 2026-01-20Buying US Stock in Canada: A Comprehensive Guide

- 2026-01-16Understanding the TFSA US Stock Tax: What You Need to Know

- 2026-01-20US Stock Market Analysis: October 30, 2025

- 2026-01-15Title: Paris Climate Agreement Impacts on US Stocks

- 2026-01-18Title: Percentage of US That Own Stocks: Insights and Trends

- 2026-01-132025 US Stock Market Outlook Analysis

- 2026-01-21Foreign Stock Exchanges Recognised by the U.S.: A Comprehensive Guide

- 2026-01-16Title: US Consumer Discretionary Stocks List: A Comprehensive Guide

- 2026-01-17Chinese Banks on U.S. Stock Exchange: A New Era in Financial Integration