Unlocking the Potential of the International Stock Market

In today's interconnected world, the international stock market presents a vast array of opportunities for investors seeking to diversify their portfolios and capitalize on global growth. This article delves into the intricacies of the international stock market, exploring its benefits, challenges, and key strategies for navigating this dynamic landscape.

Understanding the International Stock Market

The international stock market refers to the collective exchanges where shares of companies from different countries are traded. This market includes major exchanges like the New York Stock Exchange (NYSE), London Stock Exchange (LSE), Tokyo Stock Exchange (TSE), and the Shanghai Stock Exchange (SSE). By investing in the international stock market, investors can gain exposure to a wide range of industries, geographies, and market capitalizations.

Benefits of Investing in the International Stock Market

Diversification: One of the primary benefits of investing in the international stock market is the ability to diversify your portfolio. By investing in companies from different countries and industries, you can reduce your exposure to the risks associated with any single market.

Access to Growth: Investing in the international stock market allows you to tap into the growth potential of emerging markets. These markets often offer higher growth rates compared to developed markets, providing investors with the opportunity to generate substantial returns.

Currency Exposure: Investing in international stocks can provide exposure to different currencies. This can be beneficial if you believe that certain currencies will appreciate against the US dollar, potentially enhancing your investment returns.

Challenges of Investing in the International Stock Market

Political and Economic Risks: Investing in the international stock market involves navigating the political and economic risks associated with different countries. Factors such as political instability, economic crises, and currency fluctuations can impact the performance of international stocks.

Regulatory Differences: Each country has its own set of regulations governing the stock market. Understanding and navigating these differences can be challenging for investors.

Language and Cultural Barriers: Investing in international stocks often requires understanding the language and culture of the country in which the company is based. This can be a barrier for investors who are not familiar with the local market.

Strategies for Navigating the International Stock Market

Research and Analysis: Conduct thorough research and analysis before investing in international stocks. This includes understanding the company's financials, business model, and the broader economic and political landscape of the country in which it operates.

Diversify Your Portfolio: Diversify your portfolio by investing in companies from different countries and industries. This can help mitigate the risks associated with any single market or sector.

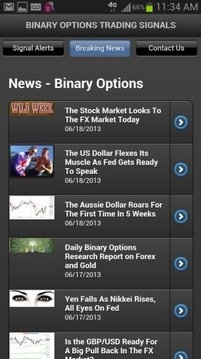

Stay Informed: Stay informed about global events and economic trends that can impact the international stock market. This includes following news, economic reports, and geopolitical developments.

Case Study: Apple Inc.

A prime example of a company that has successfully navigated the international stock market is Apple Inc. Based in the United States, Apple has expanded its operations globally, generating significant revenue from markets such as China, Europe, and Japan. By investing in Apple, investors have gained exposure to the growth potential of the technology industry and the global demand for its products.

In conclusion, the international stock market offers a world of opportunities for investors seeking to diversify their portfolios and capitalize on global growth. By understanding the benefits, challenges, and strategies for navigating this dynamic landscape, investors can make informed decisions and potentially achieve significant returns.

new york stock exchange

like

- 2026-01-15US Stock Financial Report: Unveiling the Key Trends and Insights

- 2026-01-15RLX US Stock: A Comprehensive Guide to Investing in This Growing Company

- 2026-01-22Unlocking the Power of U.S. Stock Dividends: A Comprehensive Guide

- 2026-01-20Understanding the Surge of Chinese Stocks on US Exchanges

- 2026-01-20Stock Market Performance Summary: US Markets in May 2025

- 2026-01-21Momentum Stocks: Top Performers in the US Market This Week

- 2026-01-22Explore the Thrilling World of US Army Parachutist Stock Images

- 2026-01-22US Stock Futures: A Comprehensive Guide to Investing.com

- 2026-01-23Globalfoundries US Stock: A Comprehensive Guide to Investing in the Tech Giant

- 2026-01-16"http stocks.us.reuters.com stocks fulldescription.asp rpc 66&symbol o" – Decoding the Power of Online St