Stock Market The Past Week: A Comprehensive Overview

In the ever-fluctuating world of finance, the stock market can be a rollercoaster ride, and the past week has been no exception. From dramatic swings to surprising trends, this article delves into the key highlights of the stock market in the past week, providing investors with a comprehensive overview.

Market Volatility and Key Indicators

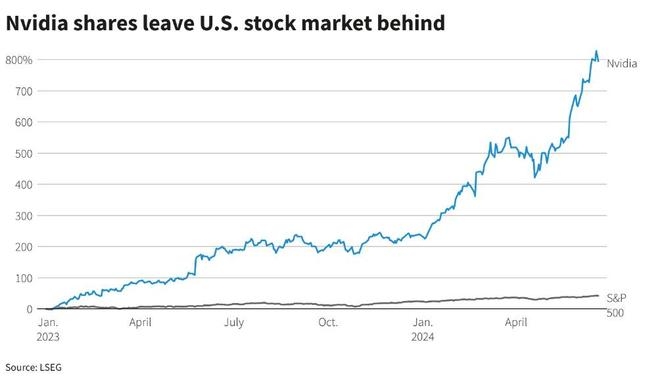

The stock market experienced significant volatility over the past week, with a mix of both ups and downs. Key indicators such as the S&P 500 and the NASDAQ Composite showed varying degrees of movement, reflecting the broader market's sentiment.

The S&P 500, a widely followed benchmark for the U.S. stock market, experienced a rollercoaster ride, dipping below 3,700 points on Monday before making a remarkable recovery to close the week above 3,800 points. This volatility can be attributed to a combination of factors, including economic data, geopolitical tensions, and corporate earnings reports.

The NASDAQ Composite, which represents the performance of technology stocks, also saw a dramatic shift in the past week. After opening the week at around 12,200 points, it soared to nearly 12,500 points, only to drop back to 12,300 points by Friday's close. This volatility in tech stocks is largely due to the sector's sensitivity to global economic and political events.

Corporate Earnings and Sector Performance

Corporate earnings reports have been a major driving force behind the stock market's movements in the past week. Several key companies, including tech giants and traditional industries, have released their quarterly earnings, providing valuable insights into the current state of the economy.

Tech stocks, particularly those in the cloud computing and social media sectors, have been on a roll, with several companies reporting strong earnings. Companies like Amazon and Microsoft saw their shares soar on the back of robust revenue growth and impressive earnings reports.

In contrast, *energy stocks have taken a hit due to the global supply concerns. With geopolitical tensions in the Middle East and rising crude oil prices, investors have become cautious about the sector's prospects.

Global Economic Factors

The global economic landscape has also played a significant role in shaping the stock market's trajectory in the past week. Concerns over rising inflation, supply chain disruptions, and the ongoing COVID-19 pandemic have kept investors on their toes.

Rising Inflation and Interest Rates

The past week has seen a renewed focus on inflation and interest rates, with the Federal Reserve signaling its intent to raise interest rates to combat rising inflation. This has led to increased uncertainty in the market, as investors weigh the potential impact of higher borrowing costs on corporate earnings and economic growth.

Supply Chain Disruptions and COVID-19 Pandemic

Supply chain disruptions and the ongoing COVID-19 pandemic have continued to create challenges for businesses across various sectors. As global demand for goods and services remains high, supply chain bottlenecks have become a common occurrence, affecting the profitability of companies.

Case Study: Tesla's Record-Breaking Week

One of the most notable stories in the stock market last week was Tesla's (TSLA) impressive performance. The electric vehicle manufacturer saw its stock reach a new all-time high, surpassing $1 trillion in market value. This record-breaking week can be attributed to the company's strong financial performance, innovation in technology, and ambitious growth plans.

Conclusion

In summary, the stock market in the past week has been marked by volatility, driven by a mix of economic indicators, corporate earnings, and global events. As investors navigate this complex landscape, it is crucial to stay informed and stay vigilant. With the market's trajectory likely to remain uncertain in the near term, investors should consider diversifying their portfolios and seeking professional financial advice.

us stock market live

like

- 2026-01-18Title: US Stock Chart History: Decoding the Past for Future Insights

- 2026-01-21Can You Buy Alibaba Stock in US? A Comprehensive Guide

- 2026-01-22In Stock Alert: Toys "R" Us Brings the Joy of Discovery

- 2026-01-22Meg Energy Corp US Stock Symbol: Everything You Need to Know

- 2026-01-22"Toys 'R' Us Stock Crew Job: A Guide to Joining the Fun at America's Favorite Toy Store"

- 2026-01-16Canadian Stock Brokers for US Residents: Your Gateway to Global Investment Opportunities

- 2026-01-16AMD US Stock: A Comprehensive Guide to Investing in Advanced Micro Devices

- 2026-01-16Small Cap Stocks News Today US: The Latest Developments and Investment Opportunities

- 2026-01-16Investing in US Stocks from Romania: A Guide for International Investors

- 2026-01-16Canadian Stock Market vs. US Stock Market: A Comprehensive Comparison