What Caused Stocks to Drop Today?

The stock market can be unpredictable, and today's sudden drop has left many investors scratching their heads. Several factors could have contributed to this decline, and in this article, we'll explore the potential reasons behind today's stock market downturn.

Economic Indicators and Data

One of the primary reasons for today's stock market drop could be the release of negative economic indicators or data. For instance, if the latest unemployment figures show an increase in job losses or if inflation rates rise unexpectedly, investors may become concerned about the overall economic outlook. These concerns can lead to a sell-off as investors rush to protect their portfolios.

Geopolitical Tensions

Geopolitical tensions can also have a significant impact on the stock market. If there's news of escalating tensions between major economies, such as the US and China, investors may become worried about the potential for a global trade war. This uncertainty can lead to a sell-off as investors seek to minimize their risks.

Corporate Earnings Reports

Another possible reason for today's stock market drop could be disappointing corporate earnings reports. If a major company misses its earnings estimates or provides a negative outlook for the future, it can have a ripple effect on the entire market. Investors may become concerned about the overall health of the economy and the prospects for individual companies.

Technological Advancements and Market Volatility

The rapid pace of technological advancements can also contribute to market volatility. For example, if a new technology is released that could disrupt an entire industry, investors may rush to sell off stocks in that sector. This can lead to a widespread sell-off and a drop in the overall stock market.

Market Sentiment and Speculation

Lastly, market sentiment and speculation can play a significant role in the stock market's movements. If there's a general sense of pessimism or uncertainty among investors, it can lead to a sell-off. Additionally, speculative trading, such as the use of leverage or margin trading, can amplify market movements and contribute to volatility.

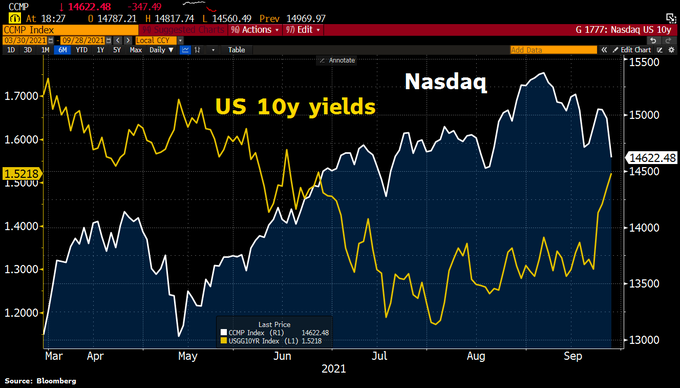

Case Study: Tech Sector Sell-Off

A prime example of how market sentiment and speculation can lead to a stock market drop is the recent sell-off in the tech sector. As concerns about rising inflation and the potential for a global economic slowdown grew, investors began to sell off tech stocks, which had been the main drivers of the stock market's growth in recent years. This sell-off not only affected tech stocks but also had a ripple effect on the broader market.

In conclusion, today's stock market drop can be attributed to a combination of factors, including economic indicators, geopolitical tensions, corporate earnings reports, technological advancements, and market sentiment. As investors, it's important to stay informed and understand the potential risks and opportunities in the market. By doing so, you can make more informed decisions and protect your portfolio.

us stock market live

like

- 2026-01-21Is the US Stock Exchange Open on Memorial Day 2019?

- 2026-01-23Unlocking Profits: Exploring US-Based Copper Stocks

- 2026-01-16The Biggest Losers in the US Stock Market

- 2026-01-16Can I Buy Stock in US Steel? A Comprehensive Guide

- 2026-01-22Top US Medical Supply Stocks to Watch in 2023"

- 2026-01-20Rare Earth Stocks: US and Australia Team Up for a Strategic Deal

- 2026-01-20Title: In-Depth Analysis of GLD: Exploring Gold Stocks on Reuters

- 2026-01-16Title: US Stock Fall Affects India Stock Market

- 2026-01-23Stock Ownership by Income Bracket in the US: Unveiling the Economic Divide

- 2026-01-20Top US Casinos Stocks to Watch in 2023