AI Stocks Momentum in the US: A Deep Dive

In recent years, the rise of Artificial Intelligence (AI) has been a game-changer across various industries. This has led to a surge in AI stocks, making them one of the most talked-about investment opportunities in the US. This article delves into the AI stocks momentum in the US, examining the factors driving this growth, the potential risks involved, and some of the key players in the market.

Understanding AI Stocks Momentum

The term "AI stocks momentum" refers to the upward trend in the stock prices of companies involved in the AI sector. This momentum is driven by a combination of factors, including increasing demand for AI services, technological advancements, and government initiatives.

Driving Factors

Increased Demand for AI Services: AI is increasingly becoming an integral part of businesses across various sectors. From healthcare to finance, AI is being used to improve efficiency, reduce costs, and enhance customer experience.

Technological Advancements: The continuous advancements in AI technology are fueling the growth of the AI stocks momentum. Companies like Google, IBM, and Microsoft are leading the way in developing new AI technologies.

Government Initiatives: Governments around the world are investing heavily in AI research and development. In the US, initiatives such as the AI Research Office at the Defense Advanced Research Projects Agency (DARPA) are driving the growth of AI stocks.

Key Players in the Market

Several companies have been at the forefront of the AI stocks momentum in the US. Some of the key players include:

IBM: Known for its AI platform Watson, IBM has been a leader in the AI industry. The company has made significant investments in AI research and development, making it a key player in the AI stocks momentum.

Google: As part of Alphabet Inc., Google has been investing heavily in AI research. Its AI division, Google Brain, has been responsible for several breakthroughs in the AI industry.

Microsoft: Microsoft's AI initiatives, including its AI and Research division, have made it a key player in the AI stocks momentum. The company's Azure cloud platform has also become a preferred choice for many businesses looking to leverage AI technology.

Intel: Known for its semiconductor business, Intel has been investing in AI research and development. Its acquisition of Mobileye, an AI company specializing in autonomous driving technology, has further strengthened its position in the AI stocks momentum.

Potential Risks

While the AI stocks momentum in the US is impressive, there are some potential risks investors should be aware of. These include:

Regulatory Uncertainty: As AI technology becomes more sophisticated, there is an increasing need for regulation to ensure ethical use and prevent misuse.

Technological Disruption: AI has the potential to disrupt various industries, which could impact the stock prices of companies in those sectors.

Competition: The AI industry is highly competitive, with several players vying for market share. This could impact the profitability and growth prospects of AI companies.

Conclusion

The AI stocks momentum in the US is a result of increasing demand for AI services, technological advancements, and government initiatives. While there are potential risks, the long-term growth prospects of the AI industry make it an attractive investment opportunity. Investors should carefully research and analyze the companies they are considering investing in to maximize their returns.

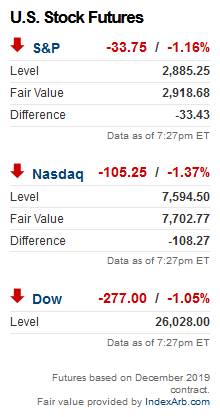

us stock market today

like

- 2026-01-16How to Invest in US Stocks from India Using Upstox

- 2026-01-16US Domestic Stocks List: A Comprehensive Guide to the Best Investments

- 2026-01-16Title: Percentage of US Population Investing in Stock Market 2021: A Comprehensive Analysis

- 2026-01-16Us Interactive Inc Stock: A Comprehensive Analysis

- 2026-01-17Historical Returns: US vs. International Stocks

- 2026-01-15Nintendo US Trading Stock: A Comprehensive Guide

- 2026-01-15Title: Canadians Owning US Stock: The Cross-Border Investment Phenomenon

- 2026-01-17Markets Open When US Stock Markets Are Closed: Exploring Global Trading Opportunities

- 2026-01-16Coal Mine Stocks: A Deep Dive into the US Market

- 2026-01-16Is China Buying US Stocks?