Are Stocks About to Crash? A Comprehensive Analysis

In the ever-volatile world of the stock market, the question of whether stocks are about to crash is a topic that keeps investors on edge. The recent economic downturn and geopolitical tensions have only added to the uncertainty. This article delves into the factors that could lead to a stock market crash and explores whether the current market conditions are indeed a precursor to such an event.

Historical Context and Market Trends

To understand the potential for a stock market crash, it's essential to examine historical trends and patterns. Over the past century, the stock market has experienced several major crashes, including the 1929 Great Depression, the 1973-1974 bear market, and the 2008 financial crisis. Each of these crashes was triggered by a combination of factors, such as excessive speculation, economic downturns, and regulatory failures.

Current Market Conditions

Today, the stock market is facing several challenges that could potentially lead to a crash. One of the most significant factors is the global economic uncertainty caused by the COVID-19 pandemic. The pandemic has disrupted supply chains, led to job losses, and caused governments around the world to implement stimulus measures to prop up the economy.

Excessive Speculation and Valuations

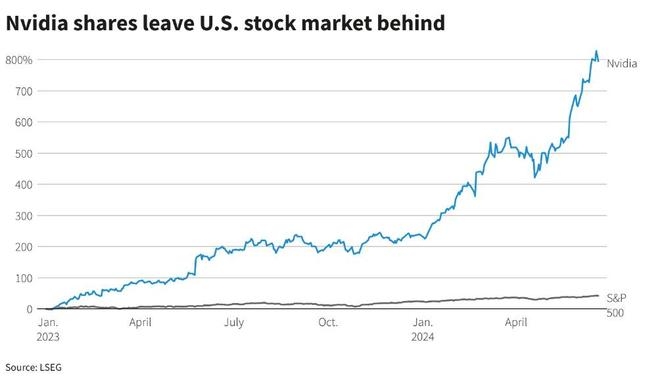

Another factor contributing to the potential for a stock market crash is the excessive speculation and high valuations in some sectors. For example, the tech industry has seen a surge in valuations, with some companies trading at sky-high multiples. This level of speculation can be unsustainable and could lead to a sudden correction if investors lose confidence.

Geopolitical Tensions

Geopolitical tensions, such as those between the United States and China, also pose a significant risk to the stock market. These tensions could lead to trade wars, which could further disrupt global supply chains and economic growth.

Case Studies

To illustrate the potential for a stock market crash, let's examine two recent examples:

The 2020 Stock Market Crash: In March 2020, the stock market experienced its fastest-ever decline, with the S&P 500 falling by nearly 30% in just a few weeks. This crash was triggered by the sudden halt in economic activity due to the COVID-19 pandemic and the subsequent implementation of stimulus measures by governments around the world.

The Dot-Com Bubble Burst: In the late 1990s, the tech industry experienced a massive bubble, with many companies trading at sky-high valuations. The bubble burst in 2000, leading to a significant decline in the stock market and a bear market that lasted until 2003.

Conclusion

While it's impossible to predict the future with certainty, the current market conditions do raise concerns about the potential for a stock market crash. Investors should be cautious and consider diversifying their portfolios to mitigate risks. By understanding the factors that could lead to a crash and staying informed about market trends, investors can make more informed decisions and protect their investments.

us stock market today

like

- 2026-01-22Upgrade Your Firearm with the Ultimate US Machine Gun Stock Adapter"

- 2026-01-18Soybean Market US Stock: A Comprehensive Guide

- 2026-01-20Us Petrol Stock: The Ultimate Guide to Understanding and Investing"

- 2026-01-15Safe US Dividend Stocks: A Guide to Secure Investment Opportunities

- 2026-01-16Gold and Stock Market: A Comprehensive Analysis in US News

- 2026-01-23Market History Chart: A Comprehensive Guide to Understanding Stock Trends

- 2026-01-16US Palm Stock Pouch: The Ultimate Eco-Friendly Solution for Your Business

- 2026-01-22Can I Buy US Stocks from the Philippines? A Comprehensive Guide

- 2026-01-15Best AI Stocks to Invest In the US

- 2026-01-16Title: Stock Market Chart US: Unveiling the Power of Visual Insights