2020 US Election: The Stock Market's Reaction

The 2020 US election was a pivotal moment in American history, not just politically but also economically. The stock market's reaction to the election results was intense, reflecting the uncertainty and volatility that characterized the period. This article delves into how the stock market responded to the 2020 US election and its implications for investors.

Pre-Election Jitters and Market Volatility

Leading up to the election, the stock market experienced significant volatility. Investors were grappling with uncertainty about the outcome and its potential impact on the economy and markets. The S&P 500, a widely followed index of large-cap stocks, saw its highest levels of volatility since the 2008 financial crisis.

Election Day and Immediate Reactions

On election day, the stock market opened with a sharp decline, reflecting investors' concerns about the potential for a contested election and its impact on market stability. However, as the night progressed and it became clear that Joe Biden had a lead in the electoral college, the market began to stabilize.

Post-Election Recovery and Sector Performance

In the aftermath of the election, the stock market experienced a strong recovery. Key sectors, such as technology and healthcare, outperformed, driven by optimism about the potential for policy changes that could benefit these industries. The tech-heavy NASDAQ Composite index, in particular, saw significant gains in the weeks following the election.

The Role of Inflation and Interest Rates

One of the key factors influencing the stock market's reaction to the election was the potential for changes in monetary policy. The election of Joe Biden, who was seen as more supportive of fiscal stimulus and infrastructure spending, led to expectations of lower interest rates and higher inflation. These expectations contributed to a rally in stocks, particularly in sectors sensitive to interest rates and inflation.

Case Study: Tesla and the 2020 Election

A notable example of how the stock market responded to the 2020 election was the performance of Tesla. In the days leading up to the election, Tesla's stock price experienced significant volatility. However, once it became clear that Joe Biden would win, the stock price surged, reflecting optimism about the potential for increased government support for clean energy and electric vehicles.

Conclusion

The 2020 US election had a significant impact on the stock market, reflecting the complex interplay between politics and economics. While the market experienced volatility in the lead-up to the election, it ultimately recovered and saw strong performance in the weeks following the election. Investors should be aware of the potential for political events to influence market movements and consider the broader economic context when making investment decisions.

us stock market today live cha

like

- 2026-01-18Exchange-Listed US Stocks: Your Gateway to Global Investment Opportunities

- 2026-01-16How to Open US Stock Market: A Comprehensive Guide

- 2026-01-18US Stock Index Outlook: Navigating the Current Market Trends and Future Projections

- 2026-01-22Unlocking the Potential of 2353.TW: A Deep Dive into Reuters' Stock Ratios Analysis"

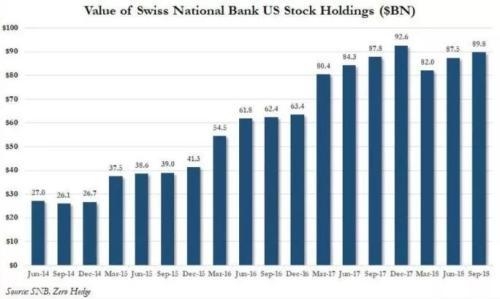

- 2026-01-16Title: Foreign Holdings of US Stocks: The Global Influence on the American Market

- 2026-01-20Gazprom Stock Price US: Current Trends and Future Projections

- 2026-01-16US Stock Market Volatility from 1871 to 1914: A Historical Chart Analysis

- 2026-01-20Discount Airlines in US Stock: Unveiling the Hidden Gems

- 2026-01-23BlackRock US Stocks Outlook: Tariffs Pause – A Fresh Perspective"

- 2026-01-20JPMorgan's Dimon Warns of Inflated US Stock Market