Understanding US Soybean Stocks: The Heart of the American Agribusiness

In the vast world of agriculture, soybeans play a pivotal role. They are not just a crop but a cornerstone of the American agribusiness sector. Known as the "golden crop," soybeans are a significant part of the agricultural economy, particularly in the United States. This article delves into the concept of US soybean stocks, examining their importance, current status, and future trends.

What Are US Soybean Stocks?

US soybean stocks refer to the total supply of soybeans in the United States, which includes both soybeans stored in silos and those held by farmers. It's a critical measure that influences global soybean prices and trade flows. The U.S. Department of Agriculture (USDA) regularly releases stock reports, providing valuable insights into the market.

The Importance of Soybean Stocks

Soybean stocks are crucial for several reasons. Firstly, they serve as a barometer of supply and demand in the soybean market. By analyzing stock levels, traders and farmers can predict future prices and adjust their strategies accordingly. Secondly, soybean stocks play a vital role in international trade. As the world's largest soybean exporter, the U.S. has a significant impact on global soybean prices and trade flows.

Current Status of US Soybean Stocks

As of the latest reports, the US soybean stocks are at a relatively low level, primarily due to strong export demand and a decrease in production. However, it's essential to note that these figures can fluctuate based on various factors such as weather conditions, trade policies, and global demand.

Future Trends of US Soybean Stocks

The future of US soybean stocks is shaped by several factors, including global demand, technological advancements, and weather patterns. The world's growing population and increasing demand for protein-rich foods are expected to drive the demand for soybeans, potentially leading to higher stock levels.

Additionally, technological advancements such as genetically modified (GM) soybeans are expected to play a crucial role in improving yields and sustainability. However, challenges such as climate change and trade disputes could impact future stock levels.

Case Studies

To illustrate the impact of US soybean stocks on the market, let's consider two case studies:

2013 U.S. Drought: In 2013, a severe drought affected the U.S. Midwest, resulting in a significant decrease in soybean yields. This led to a rise in soybean prices and reduced US soybean stocks, which impacted global markets.

China-US Trade War: The ongoing trade war between China and the United States has had a significant impact on the soybean market. China, the world's largest importer of soybeans, has reduced its imports from the U.S. in response to trade tensions. This shift in demand has affected US soybean stocks and influenced global prices.

Conclusion

In conclusion, US soybean stocks are a critical component of the global agricultural economy. Understanding their dynamics is essential for stakeholders in the industry, including farmers, traders, and consumers. As the world's demand for soybeans continues to grow, monitoring stock levels and market trends will remain a priority for the agribusiness sector.

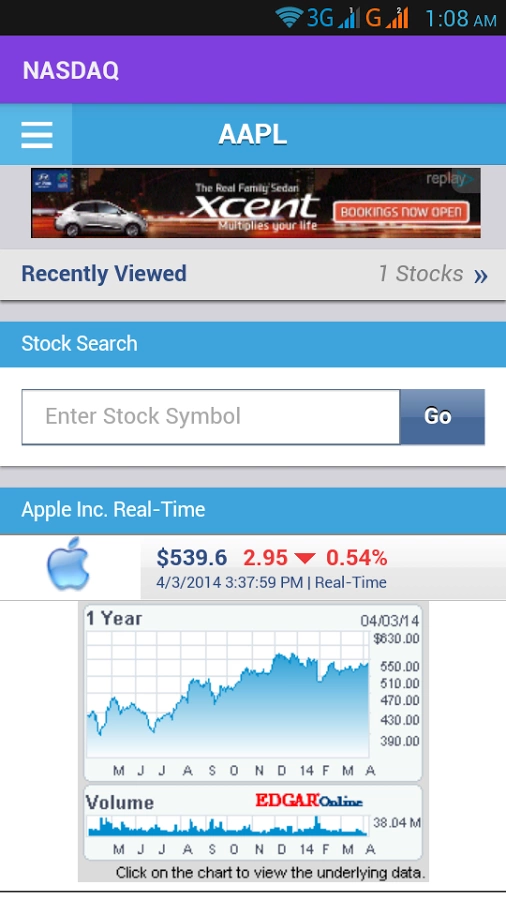

api us stock

like

- 2026-01-15Russian Stock US: A Comprehensive Guide to Investing in Russian Stocks from America

- 2025-12-31NVDA Stock Forecast 2025: What the Future Holds for NVIDIA Corporation

- 2025-12-31MSFT Price Target: A Comprehensive Analysis

- 2025-12-31Coca-Cola Dividend: Understanding the Power of Investment in the Soft Drink Giant

- 2025-12-31Title: Understanding the Market Bubble: Causes, Consequences, and Prevention

- 2025-12-31Understanding the DIA ETF: A Comprehensive Guide

- 2025-12-31AI Stocks: The Future of Investment

- 2025-12-31Swing Trading Strategies: Mastering the Art of Short-Term Investing

- 2026-01-15Title: "https www.nytimes.com 2018 02 20 us politics trump-bump-stocks.html"

- 2026-01-15Best US Cannabis Stocks to Buy in 2020