August 6, 2025: US Stock Market Summary

The US stock market experienced a tumultuous day on August 6, 2025, with a mix of gains and losses across various sectors. This article provides a comprehensive summary of the key events and trends that shaped the market on this day.

Market Overview

The S&P 500 opened lower on August 6, 2025, as investors digested a series of economic reports and corporate earnings announcements. By the end of the trading day, the index had closed slightly higher, reflecting a cautious approach among investors.

Key Events

Economic Reports: The US Department of Labor released the July jobs report, showing a modest increase in employment and a slight rise in the unemployment rate. This data provided mixed signals to investors, with some seeing it as a sign of a slowing economy while others viewed it as a sign of resilience.

Corporate Earnings: A number of major companies reported their second-quarter earnings, with mixed results. While some companies beat expectations, others missed targets, leading to volatility in the stock market.

Tech Sector: The tech sector, which has been a major driver of the stock market's growth, experienced a mixed day. Some tech giants reported strong earnings, while others faced challenges due to regulatory concerns and slowing growth.

Sector Performance

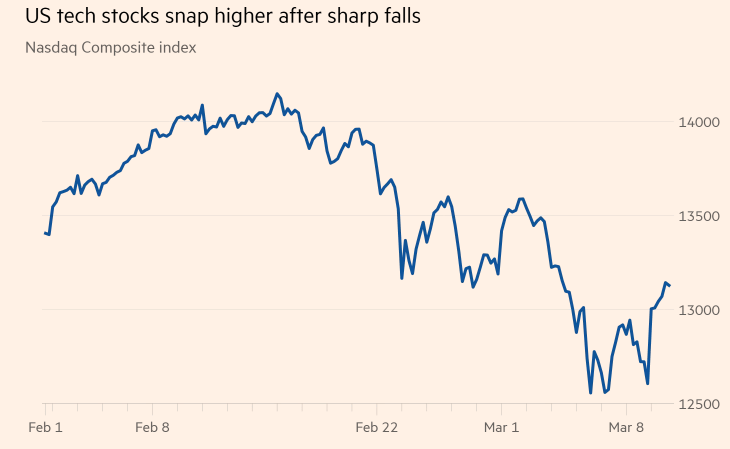

Technology: The technology sector was the biggest loser on August 6, 2025, with the NASDAQ Composite closing down 1.5%. This decline was driven by concerns about regulatory scrutiny and slowing growth in the sector.

Energy: The energy sector was the strongest performer, with the S&P 500 Energy Index closing up 2.5%. This gain was attributed to rising oil prices and strong earnings from major oil companies.

Financials: The financial sector closed slightly higher, with the S&P 500 Financials Index up 0.5%. This was driven by strong earnings from major banks and financial institutions.

Individual Stock Movements

Apple: Apple Inc. (AAPL) reported strong earnings, with revenue and profit beating expectations. The stock closed up 3% on the day.

Tesla: Tesla Inc. (TSLA) reported a loss for the second quarter, but the company's strong sales and delivery numbers helped the stock close up 2%.

Amazon: Amazon.com Inc. (AMZN) reported a decline in revenue and profit, leading to a 5% decline in the stock price.

Conclusion

The US stock market on August 6, 2025, was characterized by volatility and mixed results across various sectors. While the technology sector faced challenges, the energy and financial sectors performed well. Investors will be closely watching upcoming economic reports and corporate earnings to determine the direction of the market in the coming weeks.

can foreigners buy us stocks

like

- 2026-01-21DeepSeek US Stock Market: Unveiling the Future of Investment Opportunities

- 2026-01-04best ai companies to invest in

- 2026-01-21Navigating Canadian Taxes on U.S. Stock Purchases"

- 2026-01-15Title: Stock Markets within the US: A Comprehensive Overview

- 2026-01-20Unlocking the Potential of Shanghai Industrial Holdings Ltd: Your Ultimate Guide to US Stock Symbol

- 2026-01-21How to Buy US Stocks from Australia: A Comprehensive Guide

- 2026-01-17Title: US Steel Stock After Election: What Investors Need to Know

- 2026-01-15Understanding the US Small Cap Stock Index: A Comprehensive Guide

- 2026-01-15Title: Petroteq Stock Price US: A Comprehensive Analysis

- 2026-01-20Toy R Us in Stock Items with Parts Missing: What You Need to Know