Title: Stock Ownership Distribution in the US: A Comprehensive Overview

In today's interconnected and dynamic financial landscape, understanding the distribution of stock ownership in the United States is crucial for investors, economists, and policymakers. This article delves into the intricacies of stock ownership distribution in the US, providing a comprehensive overview of the key players and trends that shape the market.

Introduction to Stock Ownership in the US

Stock ownership in the US is distributed among various entities, including individual investors, institutional investors, and foreign investors. This diverse ownership structure contributes to the liquidity and stability of the US stock market.

Individual Investors

Individual investors play a significant role in the stock ownership landscape in the US. These investors, often referred to as retail investors, include everyday people who invest in stocks through brokerage accounts or retirement accounts such as IRAs and 401(k)s.

Institutional Investors

Institutional investors, on the other hand, are entities that pool funds from various sources, such as pension funds, insurance companies, and mutual funds, to invest in stocks. This group includes large institutional investors like BlackRock, Vanguard, and Fidelity.

Foreign Investors

Foreign investors also contribute to the stock ownership distribution in the US. These investors include individuals, corporations, and sovereign wealth funds from countries around the world.

Trends in Stock Ownership Distribution

Over the years, several trends have emerged in the distribution of stock ownership in the US:

- Rising Ownership Among Individuals: The number of individual investors in the US has been on the rise, driven by increased financial literacy and the availability of online trading platforms.

- Shift Towards Index Funds: There has been a growing preference for index funds among investors, leading to increased ownership of shares in large, well-known companies.

- Increased Influence of Institutional Investors: Institutional investors have gained significant influence over the stock market, with their decisions often driving market trends.

Case Study: The 2020 Stock Market Crash

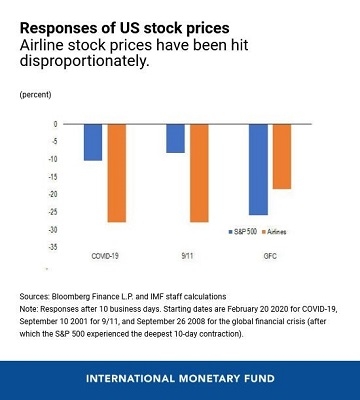

One notable example of the impact of stock ownership distribution in the US is the 2020 stock market crash. This crash, caused by the COVID-19 pandemic, led to widespread panic selling, resulting in significant market volatility. The diverse ownership structure of the US stock market helped mitigate the impact of the crash, as individual investors, institutional investors, and foreign investors responded differently to the crisis.

Conclusion

Understanding the distribution of stock ownership in the US is essential for anyone interested in the financial markets. From individual investors to institutional investors and foreign investors, each group plays a crucial role in shaping the market's direction. By analyzing the trends and case studies, we can gain valuable insights into the complex dynamics of stock ownership distribution in the US.

can foreigners buy us stocks

like

- 2026-01-16US Coal Stocks List: A Comprehensive Guide to Investing in the Coal Industry

- 2026-01-16Sorek US Stock Price: A Comprehensive Analysis

- 2026-01-16Top Dividend Stocks in the US: Your Guide to High-Yield Investments

- 2026-01-15US Stock List 0 Commission Free: The Ultimate Guide to Commission-Free Trading

- 2026-01-17US Stock Charting: A Comprehensive Guide to Understanding the Market

- 2026-01-17Understanding the US Completion Total Stock Market (TSM) Index: A Comprehensive Guide

- 2026-01-16Namaste Stock: US Ticker for a Growing Indian Giant

- 2026-01-16Understanding the US Bank Stock Market

- 2026-01-04military stocks

- 2026-01-16Stocks Under $10 US: Finding Hidden Gems in the Market