US Stock Forecast 2022: What Investors Should Expect

Introduction

As we step into the new year, investors are eager to understand what the US stock market holds for 2022. With economic uncertainties and potential market shifts, it's crucial to have a clear forecast to guide your investment decisions. In this article, we'll delve into the key factors that could impact the US stock market in the coming year and provide insights into what investors should expect.

Economic Outlook

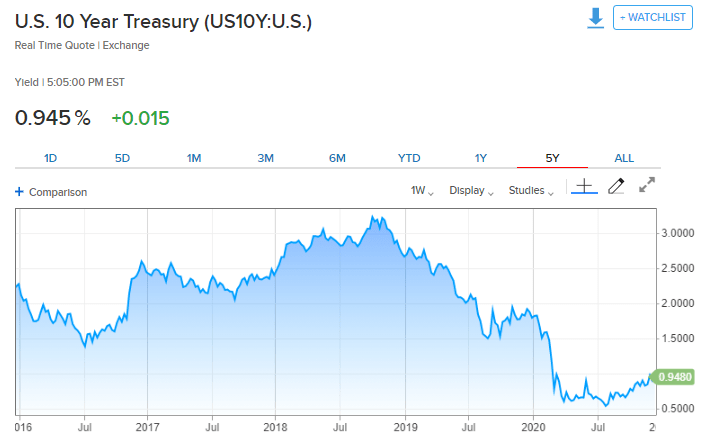

The economic landscape in 2022 is expected to be shaped by several key factors, including inflation, interest rates, and economic growth. The Federal Reserve has indicated that it will continue to raise interest rates to combat rising inflation, which could lead to increased borrowing costs for companies. However, a strong economic recovery could offset these concerns, with GDP growth expected to remain robust.

Sector Analysis

Different sectors are likely to perform differently in 2022, depending on various factors such as economic conditions, technological advancements, and regulatory changes. Here's a breakdown of some key sectors:

1. Technology

Technology stocks have been a major driver of the US stock market's growth in recent years. With continued advancements in artificial intelligence, 5G, and cloud computing, the technology sector is expected to remain strong in 2022. Companies like Apple, Microsoft, and Google are likely to continue leading the pack.

2. Healthcare

The healthcare sector has also seen significant growth, driven by the aging population and increased demand for healthcare services. Biotech companies, in particular, are expected to benefit from advancements in medical research and the development of new treatments. Names like Amgen and Johnson & Johnson are likely to remain key players in this sector.

3. Energy

The energy sector is poised for a turnaround in 2022, as the US continues to increase its oil and gas production. With the rise of renewable energy sources, companies in this sector are likely to see a mix of growth and challenges. ExxonMobil and Chevron are two major players to watch.

4. Financials

The financial sector is expected to perform well in 2022, driven by strong economic growth and increased lending activity. Banks like JPMorgan Chase and Bank of America are likely to see improved earnings and strong stock performance.

Market Trends

Several market trends are likely to shape the US stock market in 2022:

1. Dividends

Dividend stocks are expected to remain popular in 2022, as investors seek stable income sources. Companies with strong balance sheets and consistent dividend payments are likely to attract investors.

2. ESG Investing

Environmental, social, and governance (ESG) investing is becoming increasingly important. Investors are increasingly considering the impact of their investments on the environment and society, leading to a growing demand for ESG-focused funds and companies.

3. Mergers and Acquisitions

M&A activity is expected to remain strong in 2022, with companies looking to expand their market presence and enhance their competitive advantage.

Conclusion

As we navigate the US stock market in 2022, it's important to understand the key factors that could impact stock performance. By analyzing the economic outlook, sector trends, and market trends, investors can make informed decisions and position themselves for success. Whether you're a long-term investor or a short-term trader, staying informed and adaptable will be crucial in navigating the dynamic US stock market.

new york stock exchange

like

- 2026-01-13All Us Stocks List with History: A Comprehensive Guide

- 2026-01-16Title: Other Stock Exchanges in the US: A Comprehensive Guide

- 2026-01-15How Are U.S. Stocks Taxed in Canada?

- 2026-01-16EPD US Stock: A Comprehensive Guide to Understanding and Investing in Environmental, Social, and Governance (ESG) Stocks

- 2026-01-15Samsung Stock on US Market: A Comprehensive Overview

- 2026-01-16Title: Stock Market Rates in the US: A Comprehensive Guide

- 2026-01-15Title: US Defense Penny Stocks: A Lucrative Investment Opportunity

- 2026-01-16Title: Forex Pairs Traded on US Stock Exchange: A Comprehensive Guide

- 2026-01-15US Stock Futures: A Comprehensive Guide to Understanding and Trading

- 2026-01-16Chinese Investment in the US Stock Market: An Overview