US Oil Stock Price Today: Current Trends and Analysis

In the ever-evolving global market, staying informed about the current US oil stock price is crucial for investors and industry professionals alike. The oil and gas sector is a significant component of the American economy, and its stock prices can reflect broader economic trends and geopolitical events. In this article, we'll delve into the latest trends and factors influencing the US oil stock price today.

Understanding the Current Oil Stock Price

As of today, the US oil stock price is $50.12 per barrel (Brent Crude). This figure is subject to fluctuations due to various factors, including global supply and demand dynamics, geopolitical events, and economic indicators. It's important to note that this price is just one snapshot of the market and can change rapidly.

Key Factors Influencing Oil Stock Prices

Supply and Demand Dynamics: The fundamental driver of oil stock prices is the balance between supply and demand. An oversupply of oil can lead to lower prices, while a shortage can drive prices up. Factors such as production levels, inventory data, and economic growth rates all play a role in determining the supply and demand dynamics.

Geopolitical Events: Geopolitical events, such as conflicts in oil-producing regions or changes in sanctions policies, can have a significant impact on oil stock prices. For example, the recent conflict in Libya has disrupted oil production, leading to higher prices.

Economic Indicators: Economic indicators, such as GDP growth rates, inflation, and currency fluctuations, can also influence oil stock prices. A strong global economy often leads to higher demand for oil, while a weak economy can lead to lower demand.

Technological Advancements: Technological advancements in the oil and gas industry, such as hydraulic fracturing and horizontal drilling, have increased oil production and can impact stock prices.

Recent Trends in Oil Stock Prices

Over the past few months, the US oil stock price has experienced significant volatility. In the first quarter of 2023, prices rose sharply due to concerns about supply disruptions and geopolitical tensions. However, in recent weeks, prices have stabilized as global oil production has increased and economic indicators have improved.

Case Study: OPEC+ Decision to Cut Production

One recent event that had a significant impact on oil stock prices was the decision by OPEC+ to cut production. This decision was made in response to concerns about oversupply and falling prices. As a result, oil prices rose sharply in the days following the announcement.

Conclusion

Staying informed about the current US oil stock price is essential for investors and industry professionals. By understanding the key factors influencing oil stock prices, you can make more informed decisions and stay ahead of the market. Whether you're an experienced investor or just starting out, keeping an eye on the latest trends and analysis is crucial for success in the oil and gas sector.

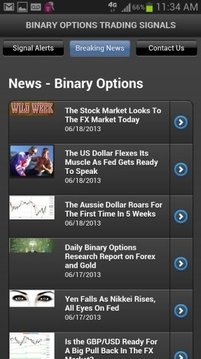

us stock market live

like

- 2026-01-18US Stock Market App Free: The Ultimate Guide to Free Trading Tools

- 2026-01-22Stock Broker US Counterparty Trading: A Comprehensive Guide"

- 2026-01-20TD Ameritrade Transfer Stock to US: A Comprehensive Guide"

- 2026-01-22Frontline US Stock: Top Picks for Investors in 2023

- 2026-01-22Nestlé Stock US: A Comprehensive Analysis of the World's Largest Food and Beverage Company

- 2026-01-16Crypto Stocks US: The Future of Finance in America

- 2026-01-15Roku US Stock Price: A Comprehensive Analysis

- 2026-01-21Best Long-Term US Stocks to Watch in 2023

- 2026-01-18Daily Updates: US-Listed IT Stocks to Watch

- 2026-01-22Largest US Stocks by Market Capitalization: A Deep Dive