Chinese vs. US Stock Market: A Comprehensive Comparison

The stock market is one of the most vital aspects of the global economy, with the Chinese and US markets being two of the most significant players. This article aims to provide a comprehensive comparison of the Chinese and US stock markets, highlighting their differences and similarities. We will delve into various aspects such as market structure, investment strategies, and potential risks and rewards.

Market Structure and Regulation

The Chinese stock market, known as the Shanghai and Shenzhen Stock Exchanges, is a major financial center in Asia. It is the second-largest stock market in the world by market capitalization, trailing only the US. The market is regulated by the China Securities Regulatory Commission (CSRC), which enforces strict regulations to ensure market stability and fairness.

In contrast, the US stock market is dominated by the New York Stock Exchange (NYSE) and the Nasdaq Stock Market. The NYSE is the largest stock exchange in the world by market capitalization, while the Nasdaq is the second-largest. The US stock market is regulated by the Securities and Exchange Commission (SEC), which aims to protect investors and maintain fair, orderly, and efficient markets.

Investment Strategies

Investors in both markets can choose from a variety of investment strategies, including growth, value, and income investing. However, there are some key differences in terms of market dynamics and investment opportunities.

Chinese Stock Market

The Chinese stock market has experienced significant growth in recent years, driven by the country's rapidly expanding economy. It is characterized by high volatility and a strong focus on technology and consumer sectors. Many Chinese companies, such as Alibaba and Tencent, are listed on the Hong Kong Stock Exchange, which is a gateway for international investors.

Investors in the Chinese stock market should be aware of the currency risk and potential political and regulatory risks. It is essential to conduct thorough research and due diligence before investing in Chinese stocks.

US Stock Market

The US stock market is known for its stability and liquidity, making it a preferred destination for many global investors. It offers a wide range of investment opportunities across various sectors, including technology, healthcare, and finance.

Investors in the US stock market should focus on companies with strong fundamentals and long-term growth potential. It is also essential to consider the tax implications of investing in US stocks, as capital gains are taxed differently in the US compared to other countries.

Risks and Rewards

Both the Chinese and US stock markets offer potential rewards, but they also come with significant risks. Some of the key risks include market volatility, political and regulatory changes, and currency fluctuations.

Chinese Stock Market

The Chinese stock market can be highly volatile, with rapid price movements driven by market sentiment and regulatory changes. Investors should be prepared for potential losses and be patient when investing in the market.

US Stock Market

The US stock market is generally more stable, but it is not immune to volatility. Investors should conduct thorough research and diversify their portfolios to mitigate risks.

Conclusion

The Chinese and US stock markets offer unique investment opportunities and challenges. While the Chinese market is characterized by high volatility and growth potential, the US market is known for its stability and liquidity. Investors should carefully consider their investment goals, risk tolerance, and market conditions before making investment decisions.

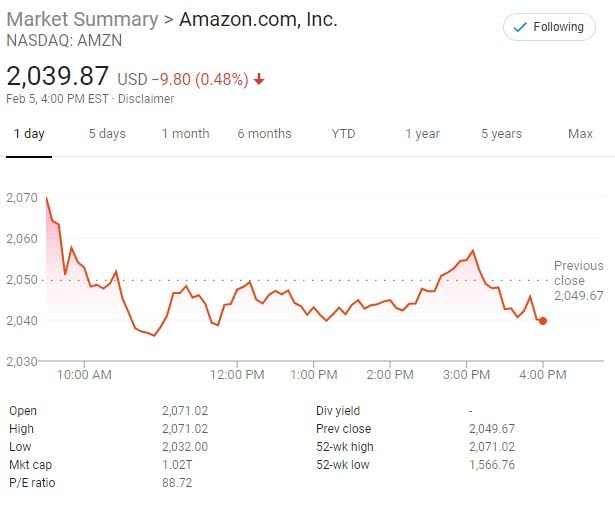

us stock market today

like

- 2026-01-15Can I Invest in the US Stock Market from Bangladesh?

- 2026-01-18Stock Watering in US History: The Rise and Fall of an Infamous Financial Practice

- 2026-01-18Paycom US Price Stock: A Comprehensive Analysis

- 2026-01-17US Insurance Company Stocks: A Comprehensive Guide to Investing

- 2026-01-16Free US Stock Market Data: Unveiling the Keys to Investment Success

- 2026-01-18March 1st, 2006 Financial Transactions Volume: Unveiling the US Stock Market Dynamics

- 2026-01-16Aurora Stock Price Today: US Market Analysis

- 2026-01-16Understanding the Stng Us Stock Price: What You Need to Know

- 2026-01-15Title: May 30, 2025: South Korea Stock Market Impact on the US Market

- 2026-01-13Delek US Holdings Stock Price: A Comprehensive Analysis