US Lime and Minerals Stock Ticker: A Comprehensive Guide

In the bustling world of financial markets, staying informed about the stocks you're interested in is crucial. One such company that has caught the attention of many investors is US Lime and Minerals. This article delves into the details of the US Lime and Minerals stock ticker, providing you with a comprehensive guide to understand its significance and potential.

Understanding the US Lime and Minerals Stock Ticker

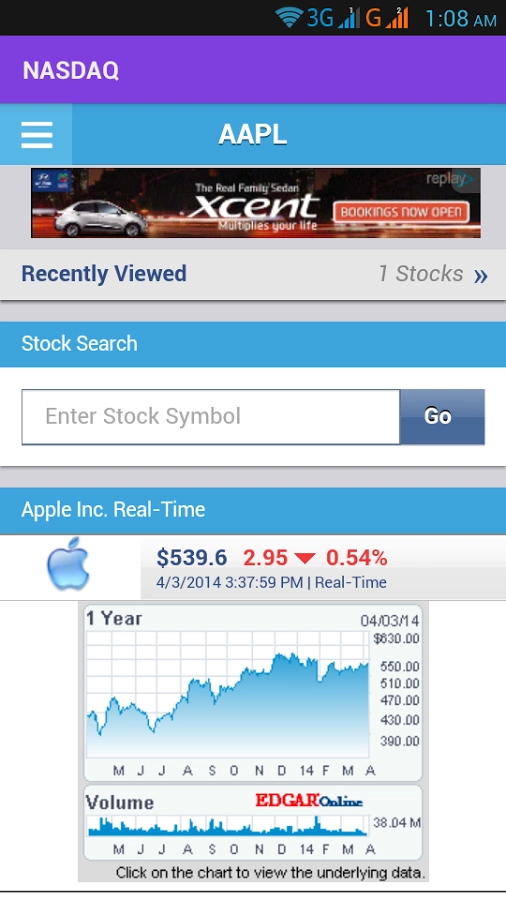

The stock ticker for US Lime and Minerals is USLM. This ticker symbol is used to identify the company's shares on various stock exchanges, such as the New York Stock Exchange (NYSE) or the NASDAQ. By monitoring this ticker, investors can keep track of the company's stock price, trading volume, and other financial metrics.

What Does US Lime and Minerals Do?

US Lime and Minerals is a leading producer of lime and limestone products. The company operates in various segments, including lime production, limestone mining, and aggregate production. These products are used in a wide range of industries, including construction, steel manufacturing, and environmental applications.

Why Invest in US Lime and Minerals?

Investing in US Lime and Minerals can be a wise decision for several reasons:

- Strong Market Position: US Lime and Minerals holds a significant market position in the lime and limestone industry, making it a stable investment.

- Diverse Product Range: The company's diverse product range ensures that it can cater to various customer needs, reducing the risk of market fluctuations.

- Growth Potential: With the increasing demand for lime and limestone products in various industries, US Lime and Minerals has a strong growth potential.

Key Financial Metrics to Watch

When analyzing US Lime and Minerals, it's essential to keep an eye on the following financial metrics:

- Revenue: Monitor the company's revenue growth to gauge its market performance.

- Earnings Per Share (EPS): EPS provides insight into the company's profitability.

- Price-to-Earnings (P/E) Ratio: This ratio compares the company's stock price to its EPS, helping investors assess its valuation.

Case Study: US Lime and Minerals' Expansion

In 2020, US Lime and Minerals announced a significant expansion project to increase its lime production capacity. This expansion was a strategic move to meet the growing demand for lime in the steel manufacturing industry. As a result, the company's stock price experienced a notable surge, showcasing the positive impact of strategic decisions on investment returns.

Conclusion

Understanding the US Lime and Minerals stock ticker is crucial for investors looking to invest in the lime and limestone industry. By monitoring the company's financial metrics and staying informed about market trends, investors can make informed decisions and potentially achieve significant returns. Keep an eye on the USLM ticker to stay updated on US Lime and Minerals' performance and growth opportunities.

us stock market today

like

- 2026-01-21How Many Stock Markets in the US: A Comprehensive Guide

- 2026-01-16US Hotel Stock List: A Comprehensive Guide to the Best Hotel Investments

- 2026-01-16Profitable US Stocks: Top Picks for Investors in 2023

- 2026-01-21Days the US Stock Market Closed in 2021: A Comprehensive Overview

- 2026-01-18Major US Airline Stocks Drop After Jefferies Downgrades

- 2026-01-21Is the US Stock Market Open on January 2, 2023?

- 2026-01-20Largest US Steel Stocks: Top Companies to Watch

- 2026-01-20Joint Stock Company: A Cornerstone of American Business Evolution

- 2026-01-15Top Stock Candy Companies in the US: Sweet Success Stories

- 2026-01-17Avino Silver & Gold Mines Ltd: A Comprehensive Analysis of Its US Stock Symbol